Back in May, U.S. Representative Andy Barr of Kentucky introduced the “No Bailouts for State, Territory, and Local Governments Act.” H.R. 5276 includes provisions designed to prohibit the Treasury and the Federal Reserve from providing direct or indirect support for state and local governments in financial distress.

The bill has attracted 31 co-sponsors, and has been referred to the House Financial Services Committee.

The crisis facing many state and local governments has become a matter of national importance, and not just because of the magnitude of the problem. Citizens and taxpayers in states that have been behaving responsibly are now at risk of subsidizing the behavior of those that have not, given that federal support is potentially available, just as it was in the financial crisis in 2007-2009.

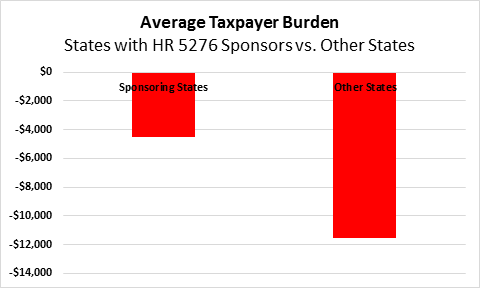

Here’s a comparison of the financial condition for states with co-sponsoring representatives on H.R. 5276 compared to the other lower 48 states in the nation, based on Truth in Accounting’s “Taxpayer Burden” measure.

Predictably, states with co-sponsoring congressmen tend to be in better shape than the other states. In fact, there isn’t a single co-sponsor from the 10 states with the highest Taxpayer Burdens among the 50 states. That includes the likes of New Jersey, Connecticut, Illinois, California and New York. Representatives from these 5 states alone account for over one-fourth of the House of Representatives.

However, it is worth noting that Rep. Barr, who introduced the bill, looks like an exception to the rule. He comes from a state (Kentucky) that is among the biggest shipwrecks, financially, in the nation.