By Bill Bergman

Public servants can raid the public purse, as Illinoisans know all too well. Paul Powell (back in the 1960s) and “that Dixon lady” (just a few years ago) provide two of the more notorious examples.

Powell served as the Illinois Secretary of State from 1965 to 1970. Back then, his annual salary was about $30,000. But when Powell died in 1970, they found $800,000 in currency stuffed into shoe boxes in the hotel room where he lived, along with 49 cases of whiskey. Investigations determined much of the loot was obtained via cash bribes. Coincidentally, or not, whenever Illinoisans paid for licenses back then, the checks were made out to “Paul Powell.”

More recently, Illinoisans have learned that local officials can have similar opportunities for “public service.” In 2012, citizens of the town of Dixon learned that their comptroller and treasurer had engineered one of the biggest municipal frauds in U.S. history, embezzling over $50 million to support her horse breeding business. Following her guilty plea, Rita Crundwell went to jail, where she is not scheduled to be released until 2030.

A few bad apples can spoil the bunch, they say.

How do you keep apples fresh? How many bad apples are there? How do you root out the bad apples hiding in the bushel?

Ellen Landgraf is a professor in the Quinlan School of Business at Loyola University Chicago (where I teach finance courses). She is an expert in forensic accounting, and some of her recent research has dealt with the incidence and mitigation of fraud in municipal government.

Landgraf is a co-author (with Laurence Johnson) of an article in the current issue of something called the Journal of Forensic and Investigative Accounting, which looks pretty interesting. Their article is titled “Anti-Fraud Measures in Local Governments.”

WIth their research funded by the Institute for Fraud Prevention, Landgraf and Johnson provide a rigorous survey of fraud risk awareness and mitigation practices in municipalities around the nation. Their survey revealed significant differences across governments. In general however, they also stress that “considerable opportunity exists for local governments to improve their formal anti-fraud efforts.”

Landgraf and Johnson identified corruption in purchasing practices as an area to stress in future research.

Just thinking out loud, buying stuff can be a good way to “eke out a living,” as they say. If a government official overpays for goods or services with public money, there may be a way to get explicit personal payments from happy suppliers. Those folks can also reciprocate with campaign donations and votes.

Earlier this year, Governing Institute released a report ranking the 50 states on the quality of their purchasing practices. Using a thorough and reasonable grading process, Governing identified the 25 “best” states, in terms of the quality, efficiency, and integrity of the purchasing process. We recently added these results in State Data Lab, using a variable that gives a 1 to states that make it to the top 25, and a zero for those that do not.

Illinois is not one of those top 25 states.

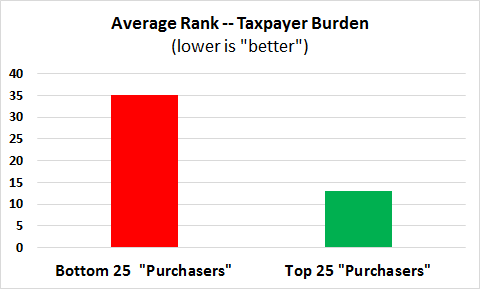

With State Data Lab, we can explore possible relationships of interest. For example, how do you think states with good purchasing practices look like, on Truth in Accounting’s “Taxpayer Burden” measure of state finances? Well, on average, states that don’t make into the “top 25” have “Taxpayer Burdens” that are three times as high as the states that do.

In turn, what kind of trust do citizens have in state government, in the “top 25” states versus the rest of the states? In State Data Lab, we also include a ranking of the 50 states based on the results of a recent Gallup poll of trust in state government.

Coincidence or not (and probably not), citizen trust in government is significantly higher in those “top 25” states.

Illinois is not one of those 25 states. Illinois ranked dead last on trust in state government in that Gallup poll. And Truth in Accounting’s “Taxpayer Burden” measure for Illinois is among the worst five in the nation.