By Bill Bergman

The finances of most state governments deteriorated somewhat in 2015, after two years of modest improvement. About 80% of the 50 states have accumulated “Taxpayer Burdens,” indicating that a full accounting for their liabilities shows more debt than assets available to pay bills.

The average “Taxpayer Burden” rose from $7,900 in 2014 to $8,200 in 2015. What this number suggests is that, were each individual income taxpayer to write a check to their state for $8,200, state governments would be back to even, on average.

There continues to be wide variations in the finances of the 50 states. The five worst “Sinkhole” states (New Jersey, Connecticut, Illinois, Kentucky, and Massachusetts) sport Taxpayer Burdens that average $44,000.

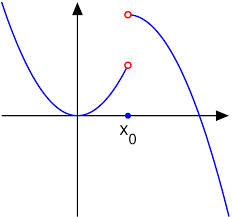

Looking across the 50 states, the share of states with improvement in their “Taxpayer Burden” fell significantly last year, after an improving trend since the bad years of 2009-2010.

2015 was notable for the arrival of a new “net pension liability” on state balance sheets, courtesy of a new government accounting standard. State (and local) governments have long excluded massive pension and other retirement benefits from the debts reported on their balance sheets. But GASB has finally implemented standards calling for these debts to be reported and included in a calculation of the reported net position.

In implementing the new standard, GASB chose to call for state and local governments to restate their beginning-of-year net positions, to reflect what they would have reported as if the standard was in effect at the outset of 2015, as well (which it wasn’t). This leads to a discontinuity in the time trend of reported results.

Truth in Accounting welcomes the long-tardy recognition of pension liabilities on the balance sheet. But we also sympathize with any citizen trying to understand their state’s financial progress, given the discontinuity and other rather-dizzying interpretation challenges under the new accounting standards.

These problems underscore the value of Truth in Accounting’s annual Financial State of the State report. We have already been calculating our Taxpayer Burden in ways that the new standards are moving toward, and have a consistent time trend from which to read state progress (or lack thereof). This will be true again next year, when state and local governments take up another leg of the previously-unreported debts, those relating to retirement health care benefits – more huge numbers.