US Published National Debt

$

The Truth

$

Each Taxpayer's Share: $914,000

Financial State of the Union 2025

According to the most recent audited Financial Report of the U.S. Government, our nation’s true debt has climbed to $158.6 trillion, burdening each federal taxpayer with $974,000.

Financial State of the Cities 2025

The Financial State of the Cities report found that 54 cities did not have enough money to pay their bills. Each city has some form of a balanced budget requirement, but this new report shows that cities have not met the intent of their requirement and have pushed costs onto future taxpayers.

Financial State of the States 2024

Our fifteenth annual Financial State of the States (FSOS) report provides a comprehensive analysis of the fiscal health of all 50 states.

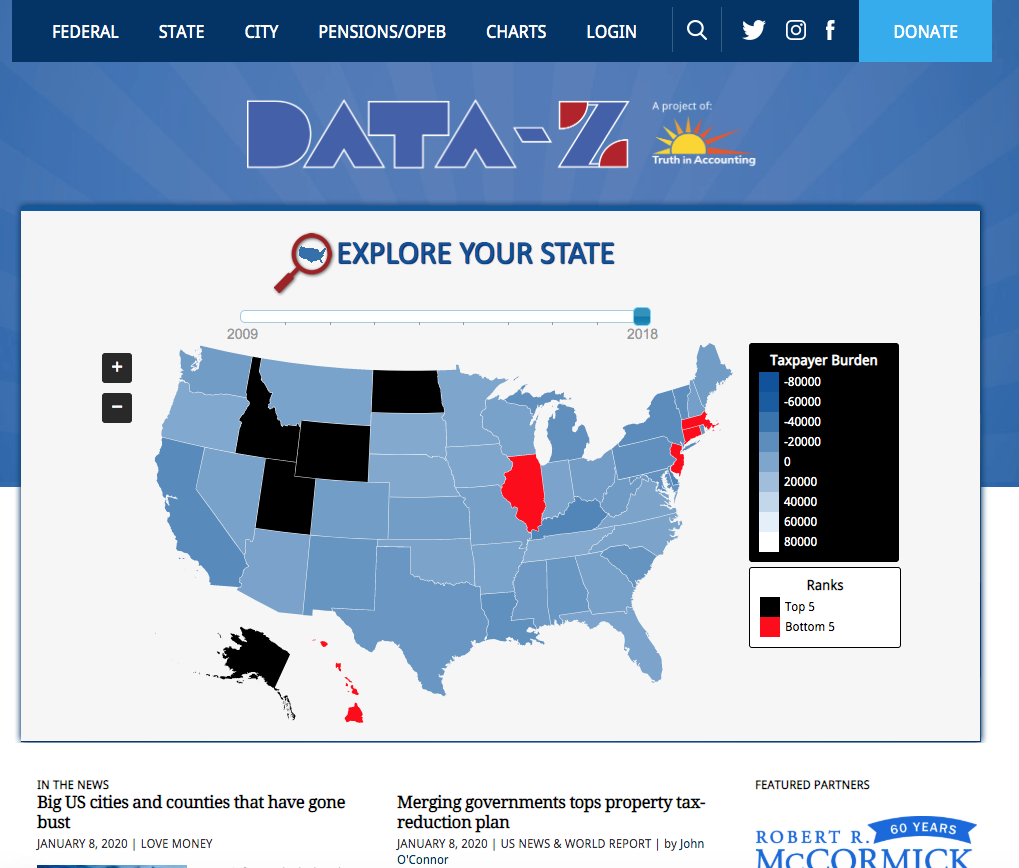

Data-Z (database for state and city data)

Create your own chart with more than 700 data variables at the federal, state, and city levels.

Truth in Accounting explains what the Moody's downgrade really means for taxpayers

May 31, 2025

The Center Square

When the U.S. lost its last AAA credit rating earlier this month, a nonprofit group that tracks government spending wasn't surprised. Truth in Accounting, which pushes for financial transparency across all levels of government, had already given the federal government its own grade: F.

Falling revenue, soaring costs threaten Pittsburgh’s financial future

May 4, 2025

The Pittsburgh Post-Gazette

For city leaders, the internal report one year ago was startling: Pittsburgh’s finances, despite the glowing claims of some elected officials, were on the brink of disaster.

Common Sense And Deficit Spending

May 2, 2025

The Connecticut Centinal

Although the state of Connecticut is sitting on a massive accumulative state pension debt of some $35 billion, most of the chatter in our media concerns the state’s biennial “surplus.”

Financial Transparency Score 2025

July 8, 2025

In the spirit of promoting clear and accurate fiscal information, Truth in Accounting has once again assessed the transparency of state governments’ financial reporting. While state budgets receive most of the public and media’s attention, their outcomes are detailed in each government's Annual Comprehensive Financial Report (ACFR), which is audited annually by certified public accountants. Our transparency score is based on key criteria outlining best practices, offering government officials and citizens a roadmap to enhance fiscal transparency and accountability.

Response to Social Security’s Go-Broke Date

June 20, 2025

The recent analysis by the Committee for a Responsible Federal Budget regarding the 2025 Medicare Trustees’ Report highlights the looming challenges with Medicare and Social Security, but it only scratches the surface of the deeper fiscal issues our country faces. To understand the full financial reality, we must go beyond trust fund “solvency” and examine the actual commitments the federal government has made—and continues to make—without fully accounting for them.

Congress Created the Oversight System. It’s Time to Oversee It.

June 6, 2025

Recent criticism of the Government Accountability Office (GAO), as reported by Politico and the Washington Post, underscores lawmakers’ frustration with its failure to address federal financial inefficiencies. They’re right to demand accountability, but Congress shares the blame—they fund the GAO and oversee the quasi-governmental board, FASAB that shapes federal accounting standards.

Credit Downgraded, Debt Upgraded: The Federal Government’s Financial Crisis

May 23, 2025

In light of Moody’s recent downgrade of the U.S. credit rating—joining S&P and Fitch in stripping the federal government of its AAA status —Truth in Accounting reiterates its longstanding concerns about the nation's fiscal health. For the seventh consecutive year, our Financial State of the Union report has assigned the federal government an “F” grade, reflecting a deep-seated financial burden.

Get this in your e-mail. Subscribe below.