The City of Chicago recently reported an alarming 50% increase in interest expense from 2014 to 2015. Last year, the city spent over $860 million in interest, before spending a dime on any public services.

There are times when organizations may find it beneficial to borrow significant amounts of money, given their growth opportunities. This does not appear to be one of them. Chicago has been spending more money than it has been taking in for a number of years, despite claiming to “balance its budget as required by state law.”

Here’s a look at what Chicago has reported for interest expense on long-term debt since 2006. Note that interest rates have been declining dramatically over this period:

How does Chicago stack up against other cities, on this score?

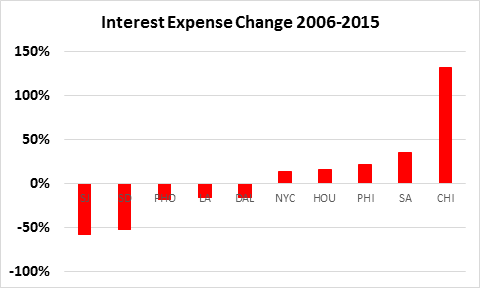

The chart below shows the percentage change in interest expense over the last 10 years for the 10 largest cities in the nation:

From lowest to highest change in interest expense, these cities are (from left to right) San Jose, San Diego, Phoenix, Los Angeles, Dallas, New York City, Houston, Philadelphia, San Antonio, and Chicago.

Chicago’s massive interest bill should be viewed in light of its investment income. Does it make sense for the city to maintain a large investment portfolio when it could be using some of those relatively low-yielding assets to pay down higher-rate debt?