Yesterday, the City Club of Chicago held an event covering the City of Chicago’s finances. Panelists included Laurence Msall of the Civic Federation, Fran Spielman of the Chicago Sun-Times, and Jennifer Boyd (S&P).

There were some good questions raised by the moderator (David Snyder), as well as audience questions. My favorite was “would you buy City of Chicago bonds?” Another good question was along the lines whether tax increases were moving the city closer to a tipping point, as outmigration might offset tax rate increases and lead to lower, not higher, tax revenue.

Laurence Msall’s presentation included a slide layering various sources of debt owed by the city, on a per-resident basis, including Chicago Public Schools debt. That serves as a reminder that the City of Chicago does not include the Chicago Public Schools in its own financial statements, a topic for another day.

That slide, and a comment from a new friend at my lunch table, sparked me to take a closer look at a “consolidated” picture, including the City of Chicago, the Chicago Public Schools, and Cook County. My new friend asked me if Cook County was in as bad shape as the City of Chicago.

This question raises some very interesting issues, given the Cook County and the City of Chicago depend on one another, as well as on the state of Illinois.

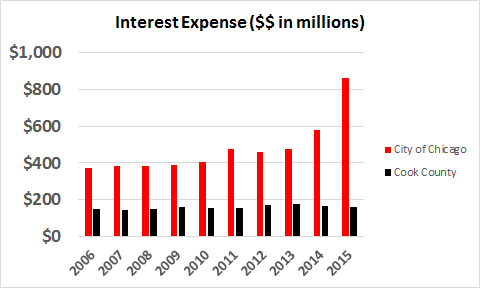

Cook County’s general revenues (taxes) were about $1.7 billion last year, one-third the amount taxed by the City of Chicago. Cook County’s interest expense was “only” $158 million last year, compared to Chicago’s staggering (and rapidly growing) $861 million in interest expense. Cook County’s interest expense has been relatively flat over the last decade, compared to accelerating growth in Chicago’s.

Here’s a look at interest expense reported by Chicago and by Cook County in the last decade.

But comparing yourself to Chicago, financially, is a pretty easy comparison. Cook County’s “unrestricted net position” (similar to equity capital, in the private sector) has been ballooning (downward) in the last decade, falling from a (negative) $333 million in 2006 to (negative) $5.3 billion in 2014, and then a sickening thud to (negative) $15 billion in 2015 with the long-delayed recognition of massive pension obligations on its balance sheet. This is a similar pattern shown in the City of Chicago’s reported results.

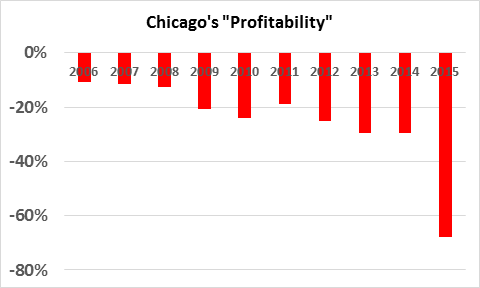

Adding things up, the chart below shows a measure of the “profitability” for Chicago, including the city, the Chicago Public Schools, and Cook County. It takes general revenue and subtracts net expenses, expressing the remainder as a percent of general revenue, like a profit margin for a private sector firm.

The alarming thud in 2015 is partly due to accounting changes for pension benefits, but the trend is unmistakable.