Earlier this week, William Glasgall of the Volcker Alliance wrote about the budget season getting underway in many states. He argued that state and local government finances could be improved with better budgeting practices. He cited New York City as a good example, as the city has incorporated GAAP for budgeting purposes. Glasgall warned it was time to be on the lookout for governments using shifty maneuvers to make it appear that spending is in line with revenue, given “balanced budget” requirements.

At Truth in Accounting, we have longstanding concerns about GAAP for governments. For decades, state and local governments accumulated massive debts outside the balance sheet, with GAAP itself responsible. The Governmental Accounting Standards Board (GASB) develops these accounting standards, which apply to annual financial reports. As problematic as these standards have been in the past, they have at least been improved with the introduction of GASB 67 and 68, requiring recognition of retirement benefit liabilities.

Depending on the state, budget accounting can be much worse. Among other budget accounting practices at odds with GAAP for governments, state and local governments can actually include new borrowing proceeds as revenue!

We can compare the states on who is really measuring up. Which states have deeds that match their words? The annual GAAP financial statements include a Statement of Activities, which is the basic income statement for state and local governments. It is structured by leading with expenses, netting out fees earned and grants for governmental activities, and then subtracting general tax revenue and other income to arrive at a “change in net position” (historically, the “change in net assets”).

In our State Data Lab facility, we include a line item we (currently) call “net revenue.” It simply takes general tax and other revenue, and subtracts expenses, leading to a bottom line. If a state or local government spends more money than it takes in, it will lead to a negative result for net revenue in these accrual accounting-based financial statements.

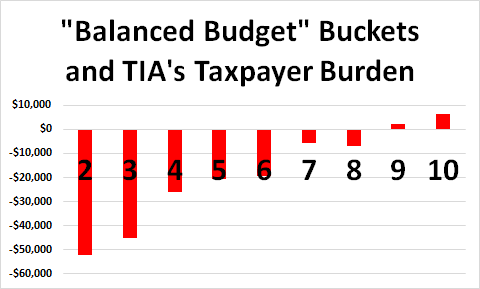

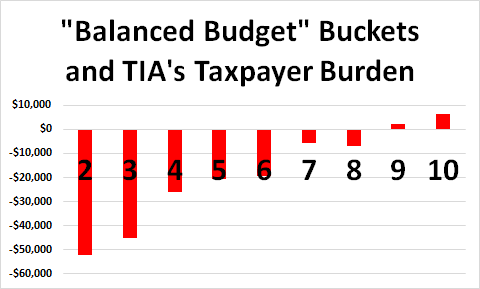

The chart below is generated after computing how many years that net revenue was positive in the 10 years ended in fiscal 2014. The states fall into nine buckets, ranging from only twice (New Jersey) and three times (Illinois) to the four states that did it every year (Maine, North Dakota, South Dakota, and Utah). For each bucket, we compute the average TIA “Taxpayer Burden,” which is represented in the columns.

You can see a clear relationship with our Taxpayer Burden measure of overall state finances. States that walk the talk tend to be in better shape.

It looks like Glasgall is really on to something. It squares with TIA’s longstanding-call for “F.A.C.T.-based budgeting.”