US Published National Debt

$

The Truth

$

Each Taxpayer's Share: $925,000

Financial State of the Cities 2026

The report examines the fiscal health of America’s five largest cities–Los Angeles, Houston, Philadelphia, Chicago, and New York City.

Financial State of the States 2025

Our sixteenth annual Financial State of the States (FSOS) report provides a comprehensive analysis of the fiscal health of all 50 states.

Financial State of the Union 2025

According to the most recent audited Financial Report of the U.S. Government, our nation’s true debt has climbed to $158.6 trillion, burdening each federal taxpayer with $974,000.

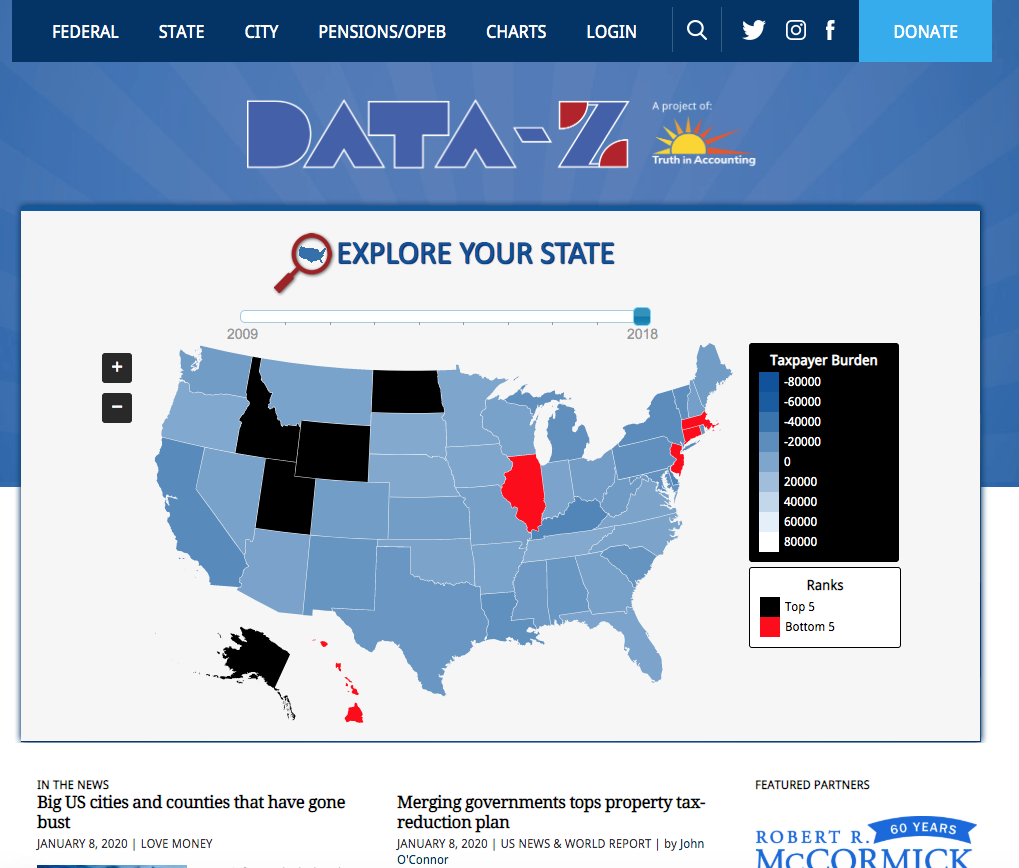

Data-Z (database for state and city data)

Create your own chart with more than 700 data variables at the federal, state, and city levels.

The Chicago Teachers’ Mystery Audits

February 1, 2026

The Wall Street Journal

The Chicago Teachers Union (CTU) has resisted making its financial audits public, and we are starting to learn why. The union recently produced audits going back to 2020, and the records show that its finances haven’t always received a clean slate by its official independent auditor.

What the fraud in Minnesota can teach Illinois

January 16, 2026

Chicago Tribune

Op-ed by Sheila Weinberg, "The Chicago Tribune recently exposed disturbing oversight failures in Minnesota’s federally funded programs, problems that have led to fraud investigations and federal payment freezes. But this is not unique to Minnesota. Illinois’s most recent Single Audit reveals similar systemic breakdowns in federal program oversight, showing that federal taxpayers’ money is at risk far beyond one state."

Federal Oversight of State Pension Plans

October 16, 2025

State pension plans, particularly those for public employees like teachers, firefighters, and government workers, are subject to various federal regulations, including IRS rules and other federal laws, to ensure compliance with tax, nondiscrimination, and retirement benefit standards. These rules apply because state pensions often receive tax advantages (e.g., tax-deferred contributions) and may opt out of Social Security; therefore, they must align with federal standards to maintain their tax-qualified status or avoid penalties. Below are detailed examples of how state pensions fall under IRS rules and other federal regulations, with a focus on key provisions and their implications.

Is Your Social Security Money Going Towards Your Retirement?

February 15, 2026

4 Myths About Social Security You Shouldn’t Believe

Taxpayers Beware: State Audit Reports Raise Red Flags—But Ignored

February 9, 2026

Your hard-earned tax dollars aren't just being mismanaged; they're being systematically stolen, thanks to a flawed government accounting system that buries red flags under layers of opacity. For years, states have been handing out federal funds through programs designed to feed children, support the vulnerable, and aid during crises. But instead of helping those in need, these programs have become playgrounds for fraudsters, with billions vanishing into luxury lifestyles and offshore accounts. The worst part? These scandals aren't surprises. They've been flagged repeatedly in mandatory state Single Audit reports, documents that auditors, lawmakers, and the federal government obviously ignore.

Georgia's 2024 Single Audit: Red Flags in Financial Controls and Federal Compliance Demand Urgent Reforms

January 21, 2026

Recent scrutiny of federal programs in Minnesota has drawn national attention to serious oversight failures at the state level. Those problems are not isolated. Audits in Georgia and other states reveal similar warning signs that raise broader concerns about accountability, internal controls, and the use of federal funds.

California’s Bad Audits Tell All

January 8, 2026

Like Minnesota, California faces serious concerns in child care oversight and other federally funded programs. The state’s 2024 Single Audit, issued in December 2025, reviews how California manages and reports on billions in federal funds. In that audit, 10 programs received qualified opinions, meaning independent auditors identified weaknesses in how the programs were run and whether federal rules were followed. These problems have led to federal payment freezes and ongoing investigations, illustrating the real-world consequences of monitoring failure.

Get this in your e-mail. Subscribe below.