The size and growth of the national debt receives deserved attention, and issues associated with how we measure federal government liabilities deserve more scrutiny. But there are some pretty important and interesting issues on the left hand side of the balance sheet, and they are a little more under the radar.

The national debt has grown significantly, but federal government assets have also been rising rapidly in recent years. In 2013, the largest line item in the reported assets was “Loans receivable, net.” In turn, within the “Loans receivable, net,” education loans amount to the largest category.

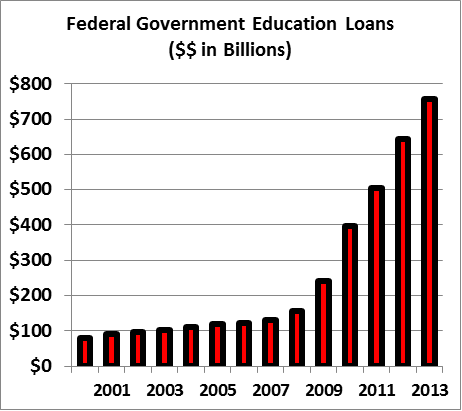

The chart below shows total loans (net) for the Federal Direct Student Loan program as well as Federal Family Education Loans. (These totals were the ones originally reported in each annual report, some of them have since been restated). Education loans have risen dramatically since the onset of the financial and economic crisis in 2007.

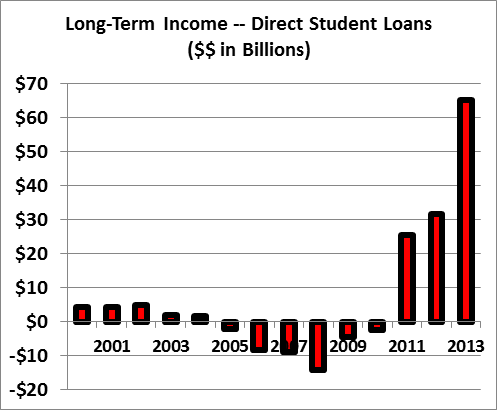

These loans are reported net of “Long-term Cost of (Income from)” loans and guarantees. Here’s what has happened to our government’s expectations of “long-term income” from direct student loans in recent years.

There is a healthy debate over how our government accounts for its student loan programs. See this article, for example. The huge swing in reported profitability certainly invites questions. Perhaps this is a good public investment, at least for our government, given the massive dislocation and reduction in job opportunities for young people in the Great Recession in recent years.

But for now, I’m reminded of a quip from Janet Yellen, during the 2007-2009 financial crisis, “Nothing on the left is right, and nothing on the right is left.”