I’m on a cool project researching the career of Paul Douglas, a former economics professor at the University of Chicago (1920s to 1945), enlisted Marine (World War II), alderman on the Chicago City Council, and United States Senator from Illinois (from the late 1940s to the 1960s). The "liberal" Douglas preached (and practiced) fiscal responsibility. He warned against inflation, and fought against government corruption and corporate welfare. In his academic work, Douglas produced prodigious statistical studies of labor markets, and was putting together his own price indexes before modern computers existed.

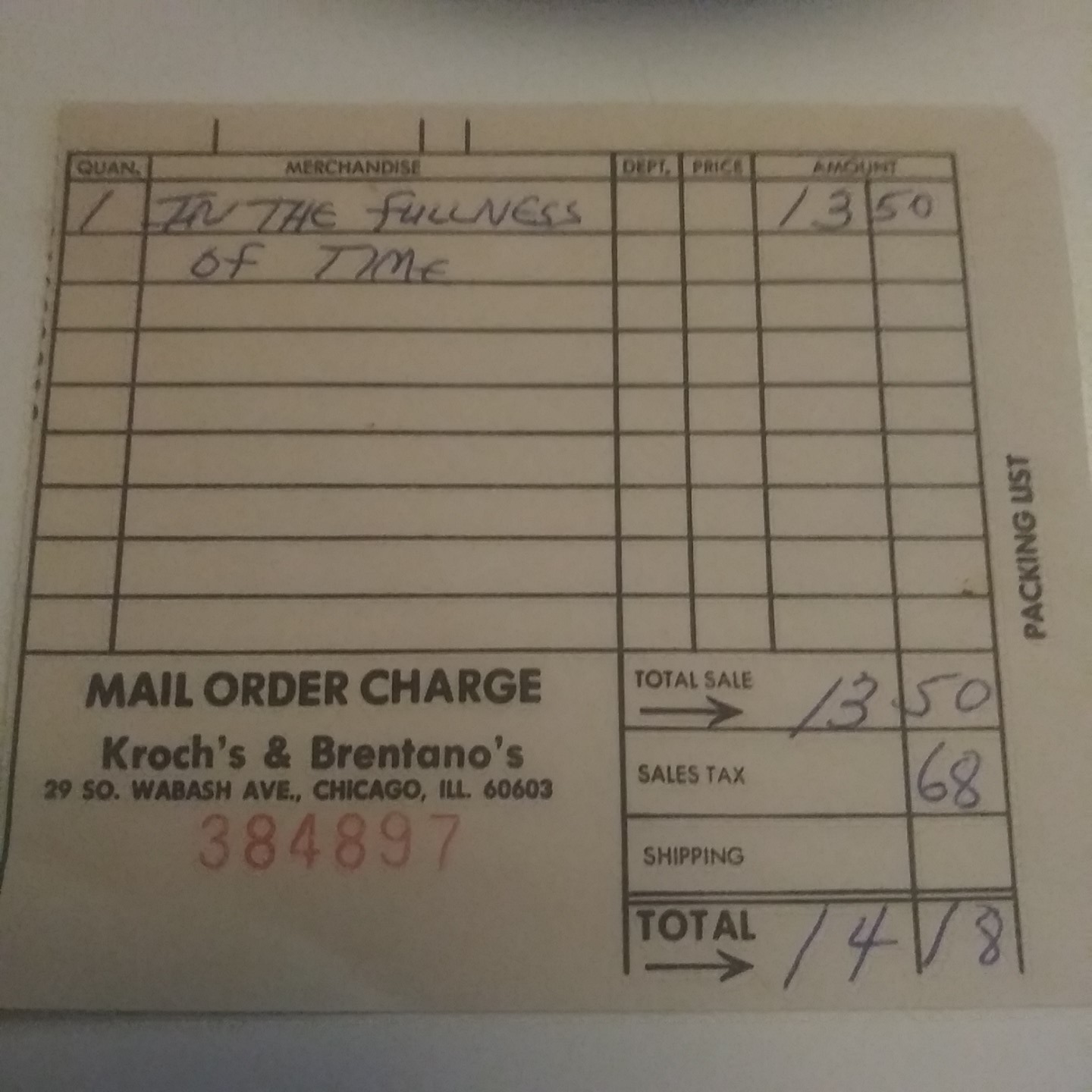

A few months ago, I picked up a very-good-condition used hardback edition of Douglas’ memoirs, In the Fullness of Time (1971). Today, on page 261, I found a pleasant surprise – the mail order sales receipt for the book when it was new, from Kroch’s & Brentano’s, a legendary downtown Chicago bookstore.

The sale price for the book on the receipt was $13.50, the same amount shown at the top of the front jacket. Right below that was the sales tax – 68 cents.

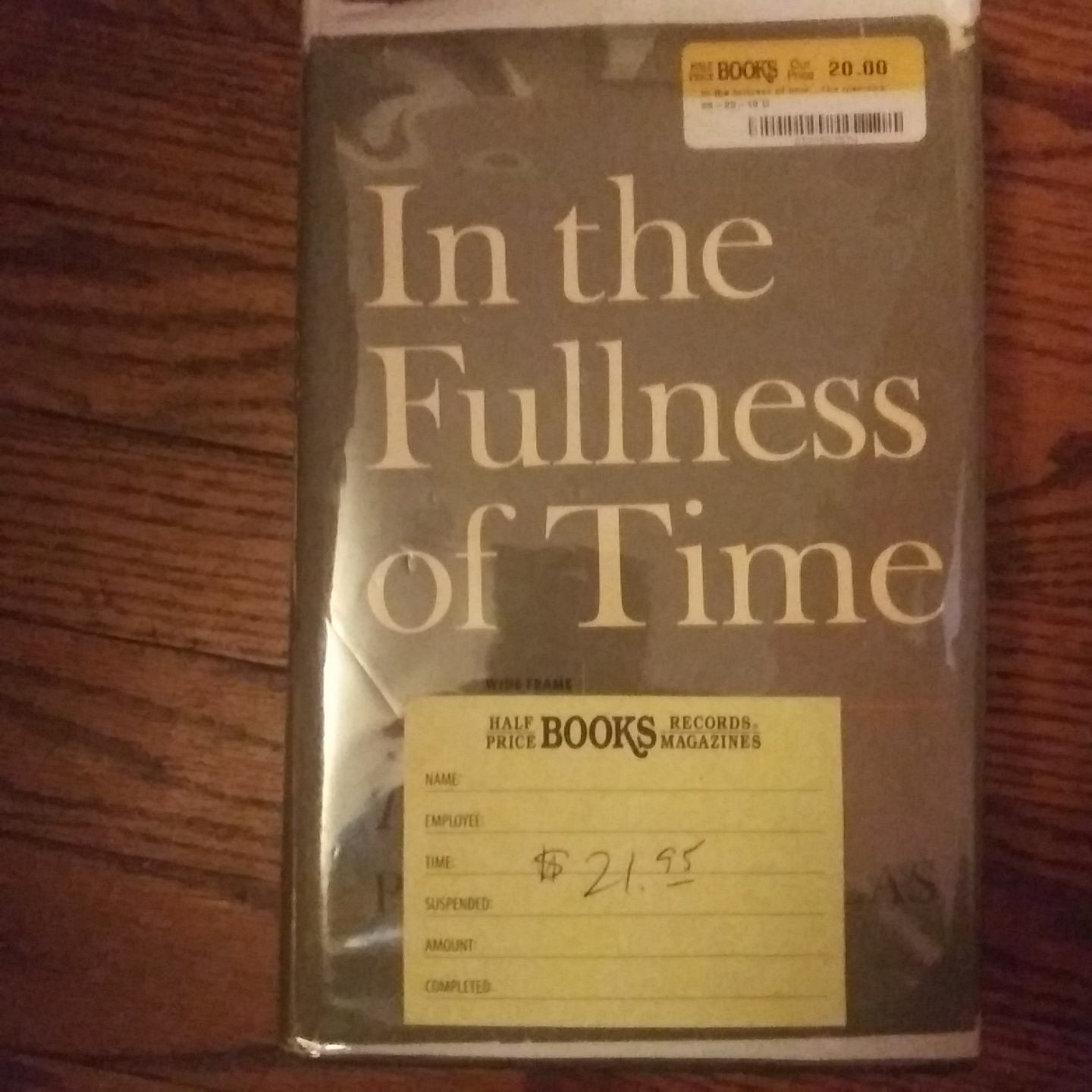

Sixty-eight cents divided by $13.50 gives you the sales tax rate at the time – 5 percent. I bought this early-1970s book used a few months ago for $20. The picture below shows what a manager at Half-Price Books (a great place, also in Cook County, Illinois) showed me what a $20 book would really cost me today, including sales tax -- $21.95.

$1.95 divided by $20 equals the sales tax rate today (also in Cook County, Illinois) – 9.75 percent. In other words, the sales tax rate has almost doubled since the early 1970s. And we aren’t talking about sales taxes doubling, we are talking about the sales tax rate – sales taxes go up with inflation, even if the sales tax rate stays the same, so this can amplify the deterioration in the “cost of living.”

For a more apples-to-apples comparison, compare the cover jacket price for Douglas’ memoirs when new ($13.50) to the cover jacket price for Michelle Obama’s recent memoirs ($32.50). On that basis, 68 cents in sales tax in the early 1970s grows to $3.17 today.

So the cost of buying a new memoir, at least, just the book, went up 2.4 times from the early 1970s to today, while the cost of the 'right' to buy the book – the sales tax – went up 4.7 times, almost twice as fast as the cost of the “thing” itself.

This simple example illuminates some interesting issues in the federal government’s accounting for inflation, as well as economic growth. For one thing, consider how the Consumer Price Index (CPI) deals with sales taxes. The Bureau of Labor Statistics (the BLS, in the United States Department of Labor) calculates the CPI. The BLS asserts:

Taxes that are directly associated with the purchase of specific goods and services (such as sales and excise taxes), as well as government user fees, are included in the CPI.

That’s true, but how are those taxes included? In the cost of goods and services that are taxed, not as a cost of government. The BLS does not include the “cost of government” in the CPI – even as our national economic statistics include “government” among the four main components of Gross Domestic Product (Consumer Spending, Investment, Government Spending, and Net Exports).

If it is good for the goose, is it good for the gander?

In 1952, while a US Senator, Douglas produced a book titled “Economy in the National Government.” The concluding chapter was titled “The Budget Must Be Balanced.” Regarding the role of government in the economy (and including government spending in GDP), Douglas was far from a blind advocate for government spending. He noted that “tax moneys are taken from individuals and corporations which, as a result, have less money to spend, save or invest.”

We should always remember that money not spent by the government could normally be spent by individuals, and we should compare the benefits of public expenditures with the unseen benefits which would have resulted from the private expenditures which were foregone.

Speaking of blind advocates, Douglas’ messages about fiscal responsibility and corruption in government should not be lost on Illinoisans, including Illinoisans promoting “multiplier effects” asserted for pension benefits on the Illinois economy -- and the cost of buying used books.