We are releasing our Financial State of the States report in batches this year as we complete them. Our analysis of all 50 states will be completed by September and we expect it to be one of the most comprehensive and timely reviews of state government finances available.

On Tuesday, we published our analysis of Illinois. The Land of Lincoln’s Taxpayer Burden™, which is our bottom-line measure of overall financial condition, came in at $50,800 for the 2017 fiscal year and is a little worse than last year’s report. Illinois will almost certainly continue to rank among the worst states in the nation financially when we have all 50 states completed.

Illinois’ Taxpayer Burden has almost doubled since 2009, which is remarkably bad given that this period included an economic recovery and a huge rally in stock markets (which should boost the funding position of state retirement benefit plans).

Once again, Illinois’ condition earned it an “F” on our grading scale, as it has consistently in recent years.

The reasons for the bad grades have real consequences.

Consider how much money the state is paying in interest expense alone, before spending a dime on public services, given the growth in debt amid the government’s long-standing failure to truly balance budgets. Despite a historic decline in interest rates, Illinois paid nearly $2 billion in interest last year, almost double what it was paying in 2009.

Illinois has lost the confidence of its residents. It ranked last in the nation in trust in state government in the latest Gallup poll, and it ranked first in the nation in outmigration by one valuable measure.

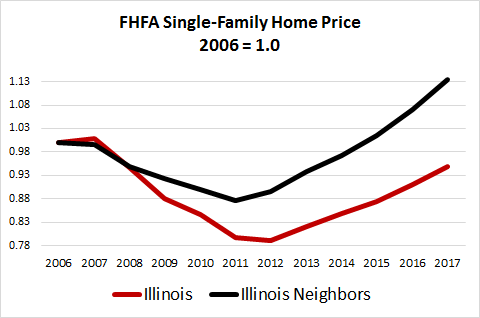

Migration and economic growth trends are reflected in how poorly Illinois housing prices have recovered since the 2009 meltdown, especially when compared to neighboring states.

Can it get much worse? Yes, it can—much worse.

Consider some perspective from banking crises and financial regulation. We regularly get our lunch handed to us by our banking system and its regulators. One of the lessons we didn’t learn from the savings and loan crisis in the 1980s was the importance of prompt corrective action in dealing with failed institutions.

Back then, a key factor trebling the cost of the crisis for taxpayers had to do with regulatory forbearance, as the regulators kicked the can down the road in dealing with the costs of insolvency in part with the aid of false accounting principles.

Allowed to stay open, failing firms had incentives to take more risks, given taxpayers had their downside.

Today, government accounting standards now are starting to reflect this long-denied reality for state and local governments. But many of the same institutions responsible for getting us into this mess are still running the show -- with significantly riskier investment portfolios backing up massively unfunded retirement benefit promises.

If we get a spike in long-term interest rates and/or significant declines from recent stock market highs, and associated retrenchment in real estate values, things could get really ugly.

Maybe the time has come for some prompt corrective action for the state of Illinois and the city of Chicago.