Do finance-heavy cities have governments with relatively strong finances? How about their states?

Consider New York City, Chicago, Hartford, and Charlotte.

New York City, home of the Big Banks and Wall Street. Chicago, with LaSalle Street, banks, insurance companies, and futures and options markets. Hartford, the “insurance capital of the world.”

And Charlotte, now considered the second-largest banking center in the nation.

One might instinctively think that governments in cities with a lot of financial talent and tradition could or should be doing relatively well, themselves, financially.

But that is far from the case.

Truth in Accounting’s analysis of the financial condition of the 75 largest cities ranked Chicago and New York City second-to-last and last, respectively, in terms of their municipal governments’ financial condition. Charlotte ranked No. 4.

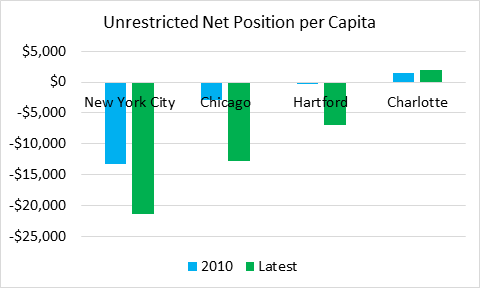

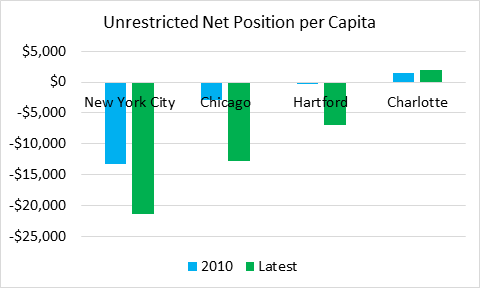

While Hartford’s population doesn’t qualify for our annual city report, here’s a look at a related metric (unrestricted net position per capita) in 2010 and the latest fiscal year for New York City, Chicago, Hartford—and for Charlotte.

Reported unrestricted net positions deteriorated significantly, on a per capita basis, for New York City, Chicago, and Hartford, from 2010 to 2017, with significant negative holes in this measure (roughly comparable to shareholder equity, or assets less liabilities, in the private sector).

In government accounting, unrestricted net position helps assess how effectively a jurisdiction has shepherded resources responsibly, avoiding spending beyond current revenues in ways that shift costs to future taxpayers.

On that score, Charlotte is a splendid and shining success, compared to other major financial centers.

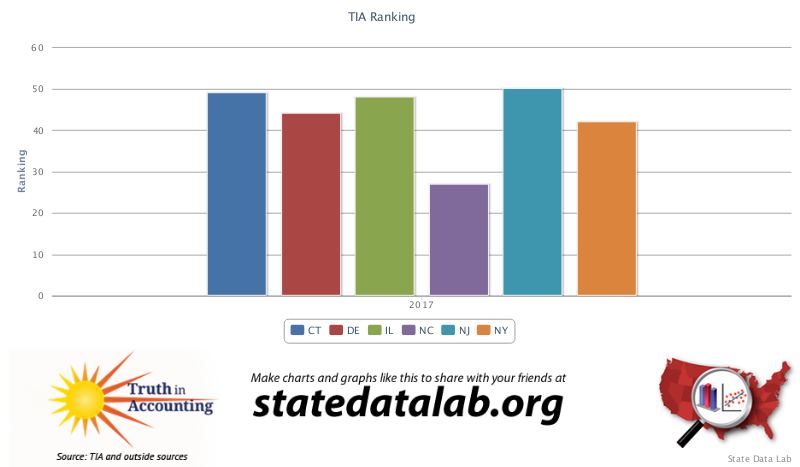

And we tend to see the same pattern for the states that are home to these cities.

The chart below shows Truth in Accounting’s rankings for the financial conditions of Connecticut, Delaware, Illinois, New Jersey, New York, and North Carolina. All of these states rank in the bottom 10 of the 50 states—except for North Carolina, which ranks about average among the 50 states.

What is going on here? Why are financially intensive city-states in relatively worse financial shape? What lessons can Charlotte provide?

Page ix (pdf page 13) of Charlotte's latest Strategic Operating Plan, titled "Finance and Budget Principles," could be a good place to start.