Chicago Mayor Rahm Emanuel on Wednesday delivered his annual budget speech.

This was his last budget address, given that he didn’t choose to run for re-election. During his speech, Emanuel claimed that Chicago’s fiscal and economic health "is stronger than it has been in many years."

The veracity of this claim may depend on what the word ‘many’ means.

The mayor asked us to think about where the city was seven years ago.

So let’s do that, especially in light of how the city claims that it balances the budget every year "as required by state law."

Here are five things to take away from Emanuel's latest budget proposal.

- It’s big.

- It’s bigger than it used to be.

- It’s “balanced” – again.

- It’s “interesting”

- There are “no new taxes.”

It’s big. Chicago’s new proposed budget calls for more than $10 billion in spending next year.

It’s bigger than it used to be. The proposed spending runs about 30 percent more than proposed in 2011 for 2012. This is curious in light of the mayor's claim, prior to his last re-election, to have “balanced the budget” without significant tax increases, by making the city “smaller, smarter, and simpler.”

It’s “balanced” – again. If the people taking care of your organization’s money told you that they were running a balanced budget, would you think your organization’s debt was going up? Wouldn’t a balanced budget at least keep your debt even, or even decline?

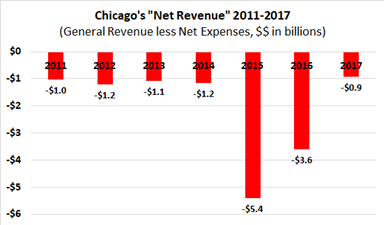

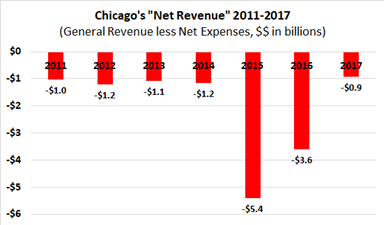

That’s not what’s been happening in Chicago. Expenses ran higher than revenue every year from 2011 to 2017.

From 2011 to 2017, the city’s total reported liabilities doubled, largely because the city finally began including pension obligations on its balance sheet a couple years ago. Excluding pensions, however, Chicago’s total reported liabilities still rose significantly from 2011 to 2017, reflecting how the city was running up the credit cards on its residents, even while telling them they were ‘balancing the budget.’

It’s “interesting.” The new budget includes more than $800 million proposed for debt service. This includes interest on bonded debt. Last year, the City of Chicago incurred more than $720 million in interest expense—up more than $200 million from 2011. That's a lot of dough, especially when it's generated by borrowing to fill gaps in “balanced” budgets.

There are “no new taxes.” Writing in Crain’s Chicago Business, Greg Hinz’s summary was headlined “No tax hikes, two big holes in Emanuel’s final budget.” Hinz is careful to qualify that there are no new tax or fee hikes “beyond those that already have been approved.” The city is in the midst of implementing large-scale property tax and other revenue increases, and the ability and willingness of taxpayers to fork over this money will be tested in the years ahead.