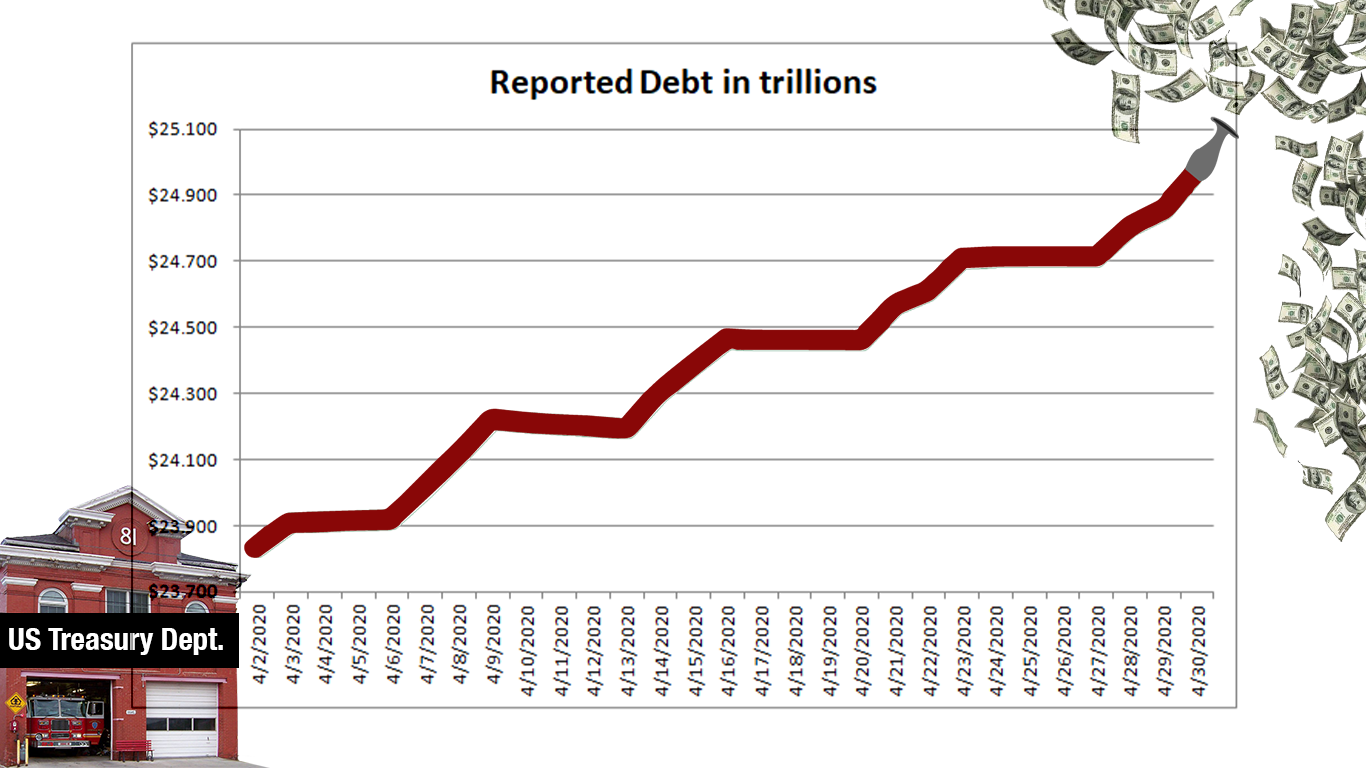

Today I realized that our debt clock was moving too slowly. I had to increase the debt clock by hundreds of billions to match how much the Treasury is currently borrowing. In April, the reported debt increased by $1.2 trillion dollars to almost $25 trillion. When the unfunded Social Security and Medicare debt promises are added, the true national debt is more than $124 trillion.

First, the federal government shuts down the economy. Now, Congress has decided the only way to save the economy is to douse every part of it with money. In March, Congress passed a $2 trillion stimulus package. This month, they added a $484 billion relief plan for businesses and hospitals. Now, they are debating legislation to bailout state and local governments, many of which were already deep in debt before the current crisis.

Fortunately, people in our country and others are willing to buy U.S. Treasury bonds that will help fund Congress’ initiatives but will add to our debt. Keep in mind, however, that some people buying the bonds may not have our best interest at heart.

We might need the money now, but, as with past borrowing, this money will probably never get paid back. Future taxpayers may be paying interest on it indefinitely. Last year, $403.6 billion was spent on interest payments, which is more than the amount spent by the Departments of Agriculture, Education, Energy, Homeland Security, Housing & Urban Development, Labor, Justice, and State combined.

Nobody seems to know when this borrowing will end, but I suspect it will not end well. Before the COVID-19 crisis, 29 percent of the budget was borrowed. What would happen if people stopped lending us money? Would we have to cut the budget by 29 percent? Will we be able to borrow enough money to get us out of this and the next crises?

Nobody seems to be worrying about this now. The fire hose of money has been turned on, flooding our country with debt.