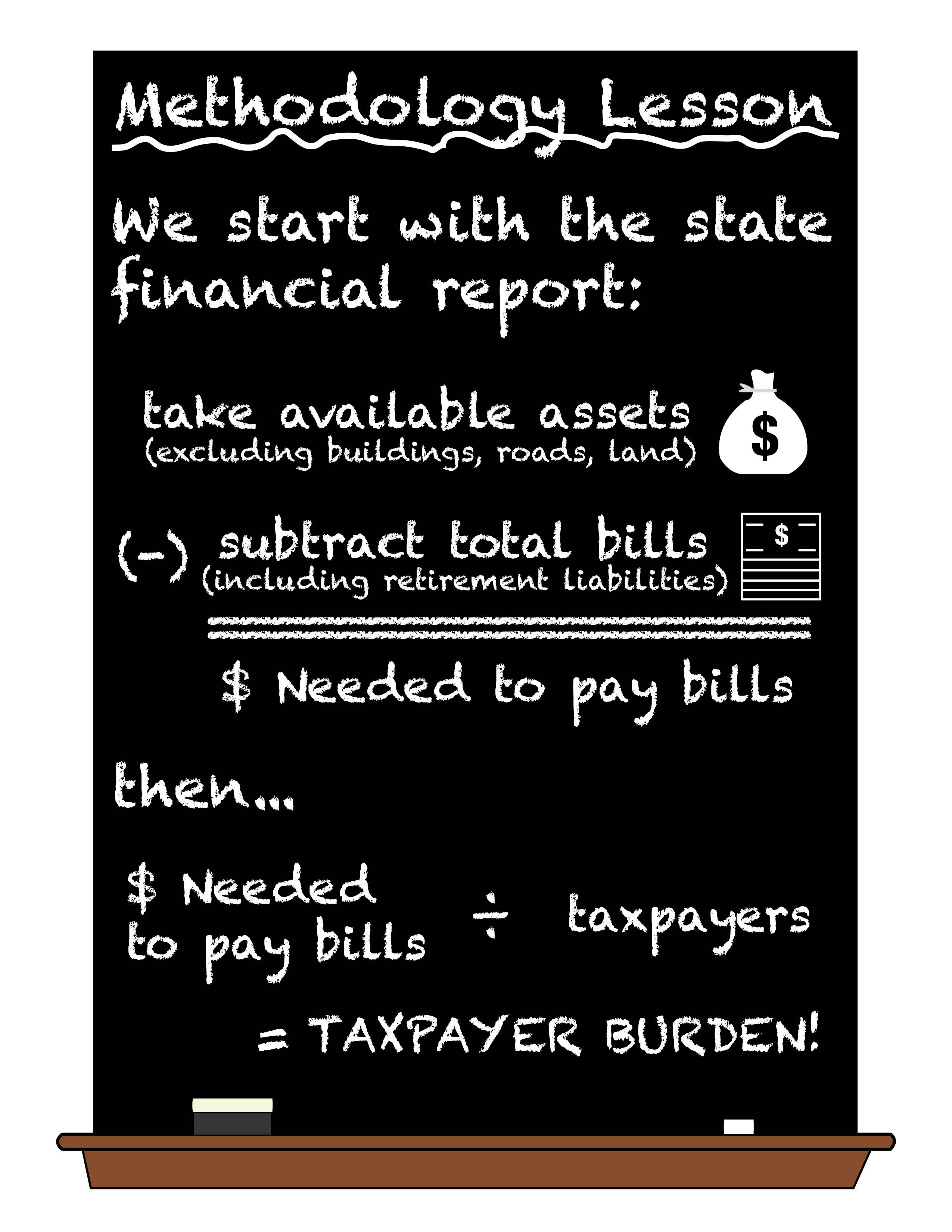

TIA researchers use a thorough approach to determine the state of government finances. This approach compares all bills–including those related to retirement systems–to the state’s assets available to pay these liabilities.

TIA begins its analysis by identifying all assets, including capital assets (e.g., buildings, roads, bridges, parks, etc. and other assets (e.g., cash, investments, and money in fund accounts. Some of these assets are available to pay a state’s bills or liabilities, while others are restricted by law or contract. The restricted assets are removed from the total, as are capital assets because they cannot be easily converted to cash. The result is a calculation of a state’s Assets Available to Pay Bills.

TIA begins its analysis by identifying all assets, including capital assets (e.g., buildings, roads, bridges, parks, etc. and other assets (e.g., cash, investments, and money in fund accounts. Some of these assets are available to pay a state’s bills or liabilities, while others are restricted by law or contract. The restricted assets are removed from the total, as are capital assets because they cannot be easily converted to cash. The result is a calculation of a state’s Assets Available to Pay Bills.

TIA then identifies Total Bills, which include liabilities disclosed in a state’s financial report such as accounts payable, bonded indebtedness (bonds, and pension and OPEB obligations found in the state’s and its retirement systems’ Comprehensive Annual Financial Reports (CAFRs). Since we removed capital assets from our computation of Assets Available to Pay Bills, we also subtract the amount of debt related to the financing of the capital assets from Total Bills.

Only liabilities incurred to date are included in Total Bills, and special care is taken to calculate the state government’s share of multiemployer and retirement plans.

TIA calculates Money Needed (or Available) to Pay Bills by subtracting the Total Bills from the Assets Available to Pay Bills.

The bottom line is expressed as Taxpayer Burden or Taxpayer Surplus. This represents each taxpayer’s share of money needed to pay bills or money available to pay future bills.

For more details, click here.