Jeffrey Tucker recently wrote an article for the American Institute for Economic Research that examines the costs and benefits of eliminating the Federal Reserve. Tucker contends that the dislocation and transition costs associated with ditching a central bank aren’t as high as one might think. Looking at the services and benefits the Fed assertably provides, Tucker took note of how market forces could deliver those services as well—and perhaps even better—in light of the historical record of the Fed and financial stability.

Among the benefits provided by the Fed, Tucker points out one very interesting service that wouldn’t necessarily go away if the Fed didn’t exist. FRED is an excellent, reliable, massive and consistently updated database of economic, financial and other information that resides on the website of the Federal Reserve Bank of St. Louis. It’s a remarkable resource that’s used by many people in financial markets, the media, and the blogosphere. It is also “free.”

Would FRED disappear if the Fed were eliminated?

In his article, Tucker writes “It’s true that the St. Louis Fed has the best online tool for data reporting but how many people know that this is actually outsourced to a private sector firm?”

If the St. Louis Fed outsources FRED, how much does it pay the vendor(s)?

Consider the market for databases, a market little old Truth in Accounting competes in with our State Data Lab resource. What if we are competing with a wonderful, massive and reliable system such as FRED, which is paid for by an organization that prints money?

If FRED is outsourced, that would help explain why, a couple years ago, when I asked folks at the Federal Reserve Bank of St. Louis how many people were working on this wonderful resource, I was told "That depends on who you ask."

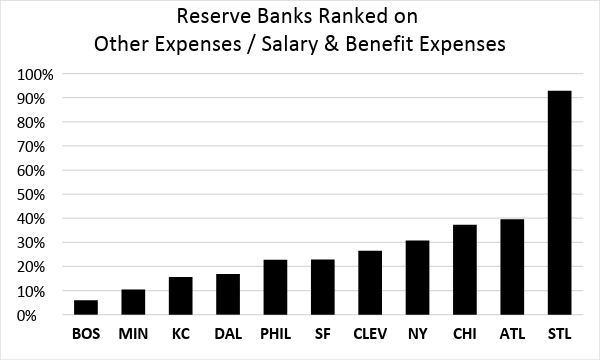

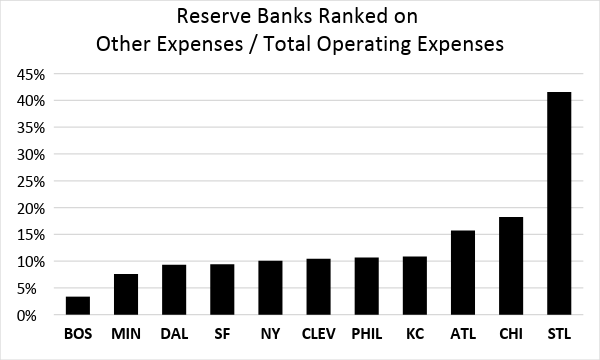

There is no explicit line-item in the financial statements for the St. Louis Fed that specifically identifies FRED. But some clues may be found in the ratio of “other expenses” to salary and benefits expenses, on the one hand, and total operating expenses, on the other hand.

If FRED is outsourced, you might expect to see a higher ratio of “other expenses” to salary and benefits expenses and total operating expenses at the Federal Reserve Bank of St. Louis, compared to other Federal Reserve banks. That is indeed the case.

The charts below show those two ratios for 11 of the 12 reserve banks for the latest year. (They exclude the Federal Reserve Bank of Richmond, which curiously reports significantly negative “other expenses,” a topic of possible future inquiry).

The St. Louis Fed is a huge outlier, with “other expenses” running far higher than the other reserve banks.

Comparing the St. Louis Fed to its in-state colleague Reserve Bank (Kansas City), and crudely assuming the differences in the other expense ratios are explained entirely by FRED, one can make a tentative estimate that FRED costs the Fed $100 million or more, per year.

Not a small chunk of change. And hard to compete with, for organizations that can’t print their own money.