Over the weekend, the New York Times published a story by Gretchen Morgenson questioning the integrity of reporting of fees paid by private equity investors. Some large investors in this area include severely underfunded public pension funds, which pose significant risks to taxpayers.

Morgenson reported on recent efforts by California Treasurer John Chiang to have legislation passed in California to improve the transparency and quality of disclosure of fees paid to investment managers. Morgenson took note of a number of subtle but significant ways that simple fee reports don’t necessarily reflect the full costs.

Morgenson interviewed a University of California-Berkeley scholar and past CalPERS board member, who reportedly stated “Now that the public has woken up to the fact that this is occurring, I suspect we are going to see a lot more proposals like the California treasurer’s.”

In turn, Morgenson closed her article with the simple statement “Pension beneficiaries and other private equity investors can only hope.”

There are other people who should hope, too. They include taxpayers standing behind investment portfolios in these plans, especially in states where court rulings have cemented promises by state and city officials in the past. Especially in Illinois and similar states with huge underfunding in their pension plans.

How heavily invested in private equity are Illinois (and Chicago) retirement plans? What kind of fees are they paying?

As Morgenson noted, the reported fees and other investment expenses may not be telling the whole story. But taking past annual reports from the Teachers’ Retirement System of Illinois (TRS) at face value, here is an introduction to looking into these questions.

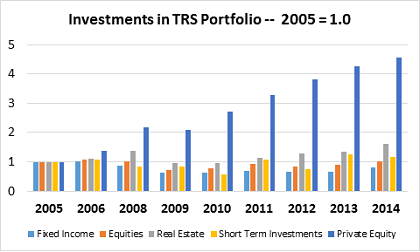

The chart below shows five different categories of investments for this plan – fixed income, equities, real estate, short-term investments, and private equity. Equities (like common stocks) are easily the highest portion of the overall portfolio. But the chart below is based on an index, where 2005=1 for all these categories. That way, you can see which categories are growing relative to the others.

From 2005 to 2014, private equity investments “held” by TRS basically quintupled, growing from $1 billion to $5 billion.

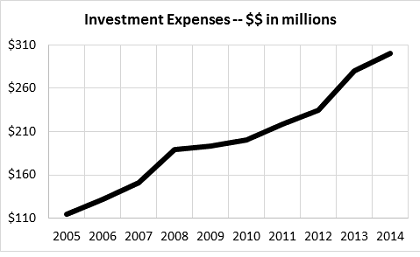

Over the same time frame, here are the reported overall investment expenses of TRS:

From 2005 to 2014, going into (and out of) one of the worst crises in U.S. financial market history, as well as a blooming underfunding crisis facing taxpayers backing Illinois pension plans, investment expenses (incurred by the plan, but earned by investment managers and others) sailed steadily higher, tripling over that decade.

Private equity investments can be growing for valid reasons, as well. But this does seem to bear looking into more carefully.