Inflation is a tax, and a pernicious one. Measuring inflation isn’t easy, and government statistics purportedly measuring inflation are subject to significant accounting issues. In recent months, however, inflation has certainly risen on the radar screen.

You don’t have to be an expert in hedonic price indexes, or related “quality adjustment” statistical issues, to get the picture these days. Especially in the last week, as both the Consumer Price Index and the Producer Price Index posted historically large increases.

In an entertaining and valuable December 14 Wall Street Journal (WSJ) op-ed, Michael Munger noted that “President Biden has proposed various plans to deal with inflation,” and he quoted eminent economist Mike Tyson – “Everybody has a plan until they get punched in the mouth.”

Who’s doing the punching? Who is the opponent?

The WSJ printed a page-one article a few days ago titled “How do you feel about inflation? The answer will help determine its longevity.” The article, written by Nick Timiraos and Gwynn Guilford, opened with these two paragraphs:

Supply-chain disruptions, labor shortages and climbing oil prices have pushed inflation to a 39-year-high. But attention is now focused on another variable: Do people think inflation is here for a while?

Because people’s expectations can factor into inflation, the answer plays a critical role in determining how the Federal Reserve and the administration manage the rising numbers—and how soon and how much the Fed will raise interest rates.

Here, the front page of the WSJ (not the editorial or op-ed pages) offers opinions about what causes inflation. “Supply-chain disruptions,” “labor shortages,” and “climbing oil prices,” first and foremost - supplemented by “how we feel” conjectures. In turn, it sounds like the Fed is our bedside psychologist. Maybe we need to heed its counseling, behave, and adjust our expectations accordingly.

But what if the Fed’s monetization of massive fiscal expansion has been a cause of the problem? What if the bedside doctor is supposedly the “cure” for a disease it inflicted on us?

In their WSJ article cited above, Timiraos and Guilford did not include the word “money,” or the phrase “money supply.”

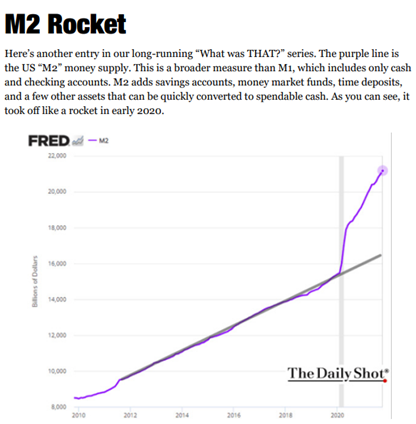

Yesterday, John Mauldin tweeted with a post he had in his popular newsletter. The tweet included this graph from “The Daily Shot.”

Maybe the money supply matters, after all.