Federal law directs the Fed to maintain the “… long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production …”

Twelve people controlling the total amount of money and credit for over 300 million other people may not make sense. But they have to count that stuff up somehow.

The Fed has done that with its M1, M2, and M3 measures of the money supply.

In early 2006, amidst a bubble that burst into the worst financial crisis since (at least) the Great Depression, the Fed stopped reporting M3.

Announcing the decision, the Fed stated that

“… M3 does not appear to convey any additional information about economic activity that is not already embodied in M2 and has not played a role in the monetary policy process for many years. Consequently, the Board judged that the costs of collecting the underlying data and publishing M3 outweigh the benefits. …”

This would imply, if M2 conveys information about economic activity, and as M3 included M2 as well as other significant forms of “money,” that the stuff that wasn’t in M2 but in M3 was not behaving much differently from M2, wouldn’t it?

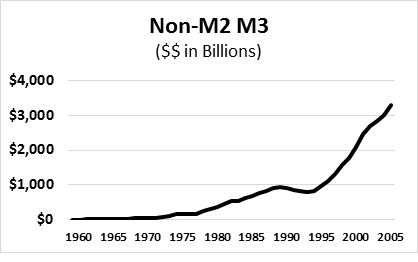

Here’s a look at “Non-M2 M3” – the stuff that wasn’t in M2 but in M3 (large time deposits, repos, Eurodollars, and institutional money market mutual funds) from 1959 to 2005. The total amount rose from $2 billion in 1960 to nearly $3.5 trillion in 2005, mushrooming especially rapidly in the decade before 2005.

Non-M2 M3 rose over $450 billion in the 12 months ended February 2006, the last month the Fed reported M3.

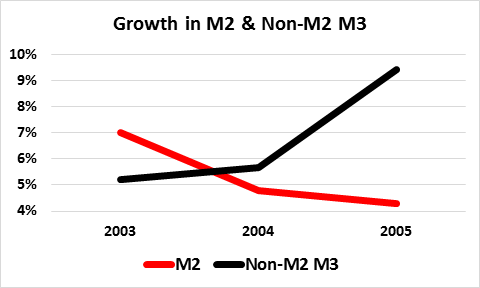

If M3 didn’t “convey any additional information about economic activity that is not already embodied in M2” as the Fed stated, one might expect M2 and Non-M2 M3 growth rates to look similar. Here they are:

Over those three years, amidst a developing housing bubble, Non-M2 M3 growth was accelerating, while M2 growth was declining.

Maybe the Fed should start reporting M3 again, and tell us what was happening in 2006 and 2007, before the meltdown.

So long as we have to have a Fed, anyway.