The federal government divides spending into two main categories – “mandatory” and “discretionary.”

Mandatory spending sounds like spending that has to happen, as opposed to discretionary spending that may or may not happen. That isn’t quite how it works, however.

A simpler and more accurate way to define the difference lies in how the two types are treated for budgetary purposes. “Discretionary” spending arises under annual appropriations, while “mandatory” spending is for programs like Social Security (and Medicare), not subject to control by annual appropriations.

Mandatory spending for Social Security benefits arrives every year under statutory formulas, unless Congress (and the President) change the law under which funding is provided.

Social Security benefits are mandatory -- unless they aren’t. Congress can change the Social Security law (and the benefits) at any time, a fact of life underlying why the federal government asserts that the massive unfunded benefit promises should not be included as liabilities on its balance sheet.

At Truth in Accounting, we believe a better approach would reflect the present value of unfunded “entitlement” benefits under current law as debt on the balance sheet – and subject to any advertised national “debt limit.”

If Social Security is an “entitlement,” are we really “entitled” to it, if Congress can change the law at any time?

Spending for interest on the national debt is another element of “mandatory” spending. Consider the implications if in fact this is another form of discretionary mandatory spending.

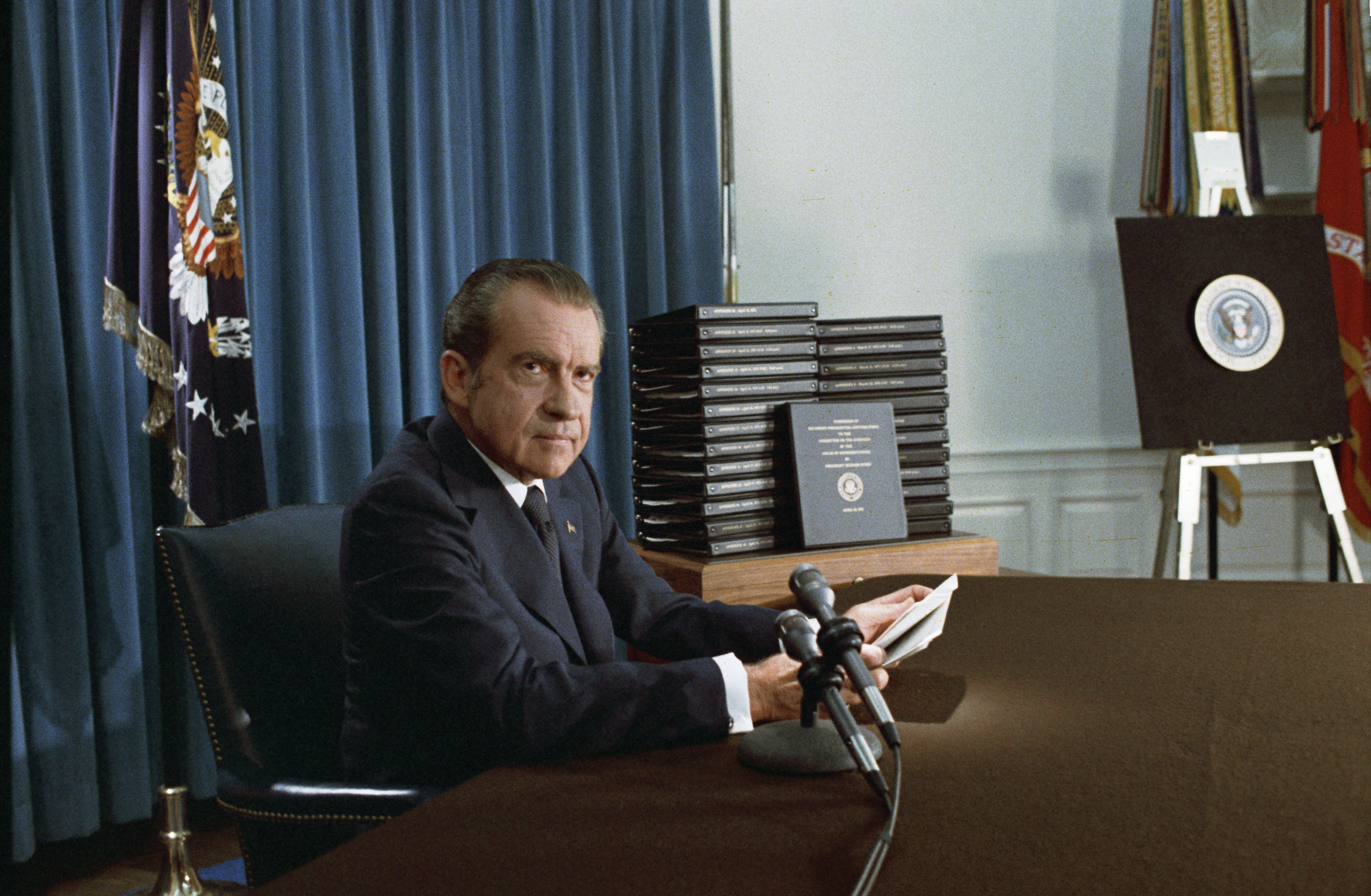

The U.S. would never do such a thing? Consider what happened in the early 1930s, and August 1971.