Many people are at least vaguely aware that the Social Security program isn’t on the soundest financial footing. But few people know of the decidedly mixed implications the program currently poses for different age groups.

Congress, the executive branch and the public at large long have known the system faces challenges in coming decades as the baby boomer generation retires and begins drawing benefits. Still, we keep letting things go on as normal, at least for now, as cash flows from tax revenue are sufficient to pay out benefits.

So how do we gauge the current status of a program that promises benefits (and taxes) far into the future?

In finance, students learn about the importance of “present value” concepts. A dollar today is worth more than a dollar tomorrow, given the time value of money (which could have been invested) and risk (a bird in the hand is worth two in the bush, if birds in bushes can fly away).

Given a dollar today is worth more than a dollar tomorrow, we learn to discount future dollars to a smaller present value today by using discount rates.

In the latest Financial Report of the U.S. Government, the fiscal status of Social Security (and Medicare) can be tracked on the “Statements of Social Insurance” (see tables on p. 57 here). The table for the Social Security program reports the present value of future revenues (taxes) and expenditures (benefits), the sum of which is the net present value, or the present value of revenues less expenditures. These present values depend on defensible forecasts, given demographic and other assumptions.

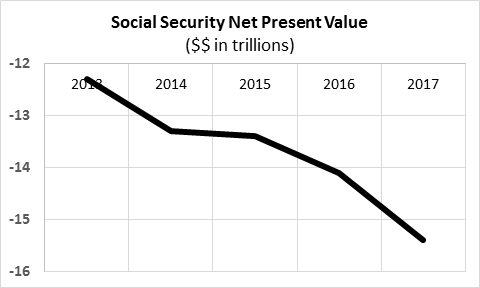

The chart below shows the massively negative and deteriorating net present value for the Social Security program in the last five years. Under current law, the present value of future expenditures now dwarfs future revenues by more than $15 trillion.

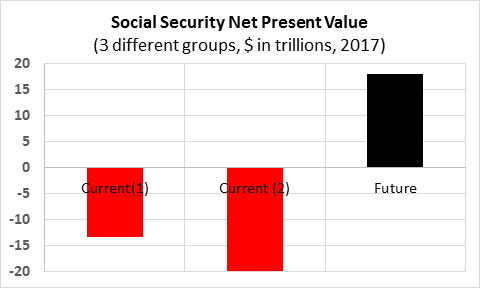

What’s interesting, mind-numbing and alarming is what happens when you look at three different classes of participants that add up to this huge negative number.

The overall totals above include expected results for current participants that have reached eligibility age, current participants that have not reached eligibility age and “future participants”like the young and the unborn.

Who do you think fares well, under current law? Who do you think fares poorly?

The chart below shows the program’s net present value for these three groups. What becomes clear is that the latest $15 trillion shortfall arrives despite a huge positive contribution from future participants.

In other words, current participants themselves have a cushy, positive present value deal but at the expense of the young and the unborn.

Taxation without representation, anyone?