The latest actuarial valuation report for the Public School Teachers’ Pension and Retirement Fund of Chicago includes projections for the plan’s contributions, benefit payments, investment earnings, and net position.

The plan’s overall annual financial report (different from the annual report from the actuaries) identifies the ‘fiduciary net position’ more formally as ‘Net Position Restricted for Pension Benefits.’ It basically represents plan assets (including investments) less liabilities (principally for current benefit payments). In the latest overall financial report, the plan reported $10 billion (positive) in ‘Net Position Restricted for Pension Benefits.’

But the overall report’s ‘Schedule of Funding Progress’ provides another window into the health of the plan. It yields a ‘funded ratio’ after taking the actuarial valuation for plan assets, and dividing it by the ‘actuarial accrued liability’ (based on the present value of future pension payments obligated under law). In 2016, the plan reported a funded ratio of just 52%, down from over 80% a decade earlier.

What does the future hold?

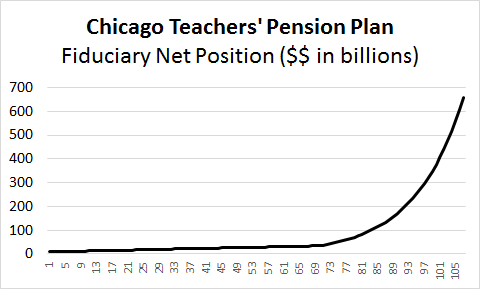

The projections from the actuarial report for the teachers’ pension plan can be found on pages 56-58 here. They show the fiduciary net position rising through the forecast horizon (107 years!), from $10 billion today to over $655 billion by 2124.

Sounds like a pretty healthy plan, doesn’t it?

Here’s a picture of what that projected net position looks like over the next 107 years.

It rises (in theory) from $10 billion today to about $20 billion by 2080, and then the projected growth rate rises sharply.

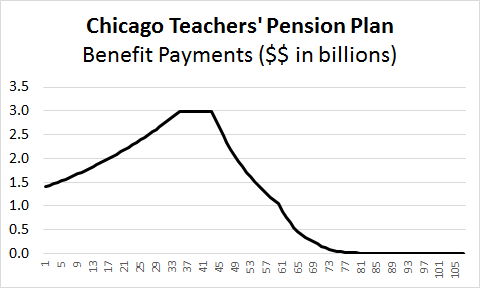

In the same table, the actuarial projection for benefit payments looks like this:

How can the plan project ‘fiduciary’ net position to skyrocket to $655 billion over the next century, and at the same time, project benefit payments to fall from $3 billion a year to next-to-nothing ($1,215, total, actually) in year 107?

If the net position is a ‘fiduciary’ position, owed to beneficiaries, who gets that $655 billion empire, if benefit payments are projected to fall to nothing?

The actuary may not be providing these projections entirely as a matter of choice. A footnote to that projection table notes that the contributions are projected ‘as required by Paragraph 41 of Statement 67.’ That would be GASB 67, the new standard for pension accounting from the Governmental Accounting Standards Board.

What are they projecting there? Contributions rising from $870 million in year 0 (up from about $100 million just a few years ago) to about $1.4 billion over the next 25 years.

Good luck with that one, taxpayers.