The reported national debt has been rising pretty rapidly in recent decades. Since 1980, the “public debt” reported by the U.S. Treasury has risen much faster than overall economic activity, rising from 20% to 100% of GDP. The debt to GDP ratio is now higher than it has ever been since World War II.

In recent years, our federal government’s own financial report has been warning that the government’s fiscal path is “unsustainable.” The national debt has already been rising rapidly, but under current law, facing demographic and other challenges, the government projects a massive increase in federal debt in the next few decades.

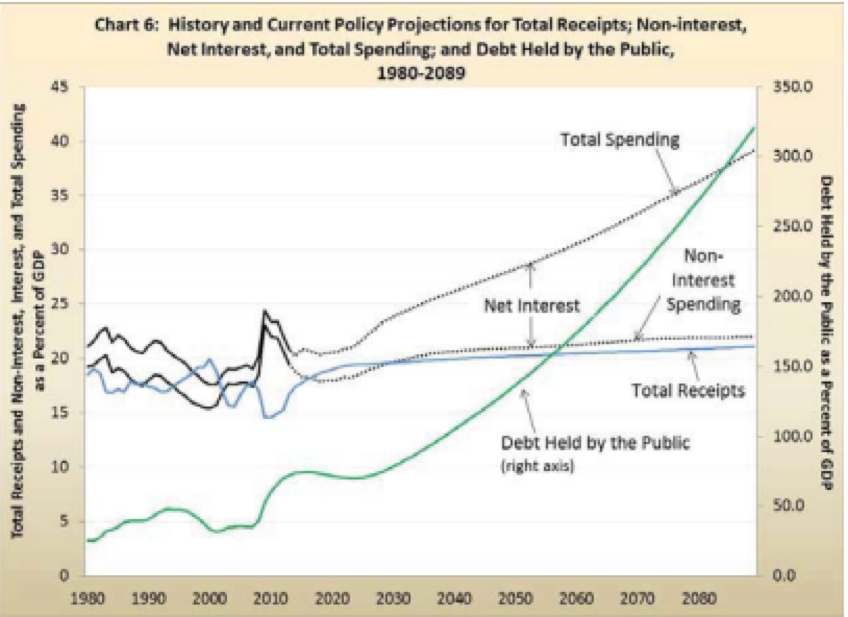

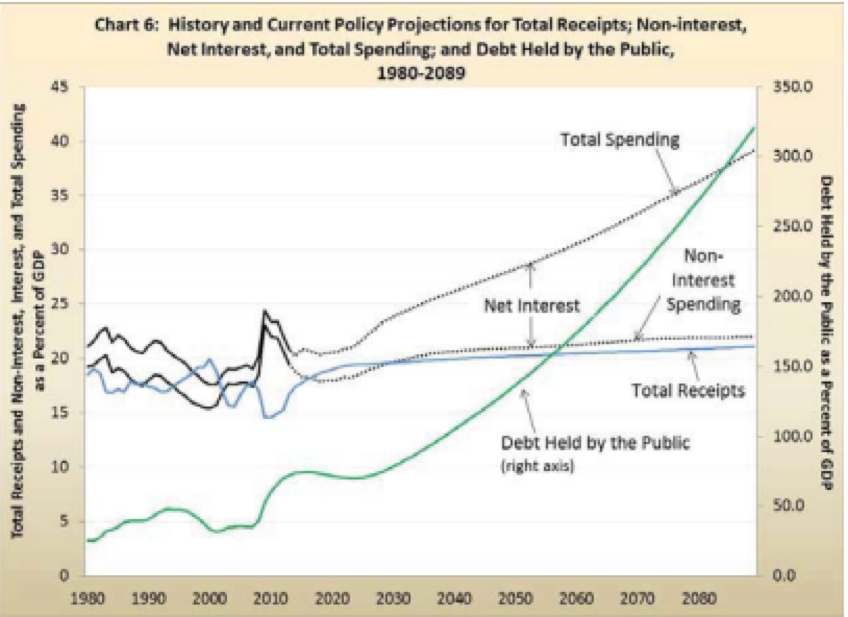

The annual financial report of the US government includes what it calls a “75-year fiscal gap.” You can see the report for 2014 here. If you search for the phrase “fiscal gap,” you will see this concept introduced on page vi in the “Citizen’s Guide” introduction to the report. That page also includes a chart showing “debt held by the public” (public debt less intragovernmental holdings like the Social Security “Trust Fund”) rising dramatically as a percent of GDP under current law and policy, rising from about 80% today to over 250% in 2080.

This discussion concludes that “the continuous rise of the debt to GDP ratio after 2024 indicates that current policy is unsustainable.” Then, it defines the “fiscal gap:”

“It is estimated that preventing the debt-to-GDP ratio from rising over the next 75 years would require some combination of spending reductions and receipt increases that amount to 2.1 percent of GDP on average over the next 75 years.”

Does a fiscal gap of 2.1 percent of GDP sound like a big deal? Well, 2.1 percent of $18 trillion dollars is a big deal today, almost $400 billion, and that is only for one year. The magnitude of these tax increases and spending cuts can also be brought home by thinking in terms of GDP growth. At recent growth rates, were they to continue, on average, over the next 75 years, these spending cuts and tax increases could eat up fully half of our future economic growth, although the real economic impact is a difficult thing to estimate well.

Bottom line, it’s a lot of dough. But the government’s financial report provides a related warning – that waiting to address the issue is costly all by itself. The longer we wait, the argument goes, the worse it gets.

“For example, relative to a policy that begins immediately, if action is delayed by 10 years, it is estimated that the magnitude of reforms necessary to close the 75-year fiscal gap will increase by nearly 20 percent; if action is delayed by 20 years, the magnitude of reforms necessary will increase by nearly 50 percent.”

In light of the omnibus spending bill recently passed by Congress and signed by the President, a bill that the CBO has estimated will reverse previous progress on reducing the national budget deficit, it is difficult to foresee much improvement in the flavor of the discussion of the fiscal gap in the Financial Report of the U.S. Government. That report will likely be delivered in the next few weeks, and we will be watching this (and other) sections of the report closely.