Today, the federal government has reached agreement on a massive spending deal purportedly designed to support the economy amidst the impact of a spreading pandemic.

Is that the only motivation? Can the federal government afford it?

We continue to analyze the recently released Financial Report of the U.S. Government for 2019 and expect to have our analysis of that report done soon.

For now, here’s a worrisome symptom from simple word counts for that report.

Beginning in 2010, the report began with a formal analysis of the “fiscal gap” challenge facing the federal government. This followed growing concern expressed in the report about the long-run sustainability of federal finances.

Granted, in the last few years, the whole world has flocked to U.S. Treasuries in a “flight to quality” – especially amidst crisis-like financial conditions in recent months. But what if the flock of birds changes its mind about how safe that beach is?

The “fiscal gap” discussions in the Financial Report of the U.S. Government are based on quantifying the combination of federal spending cuts and/or tax increases needed to keep the federal debt to Gross Domestic Product (GDP) ratio from a sharp future upward projected path, one deemed “unsustainable” by the report’s authors (as well as more than a few outside observers).

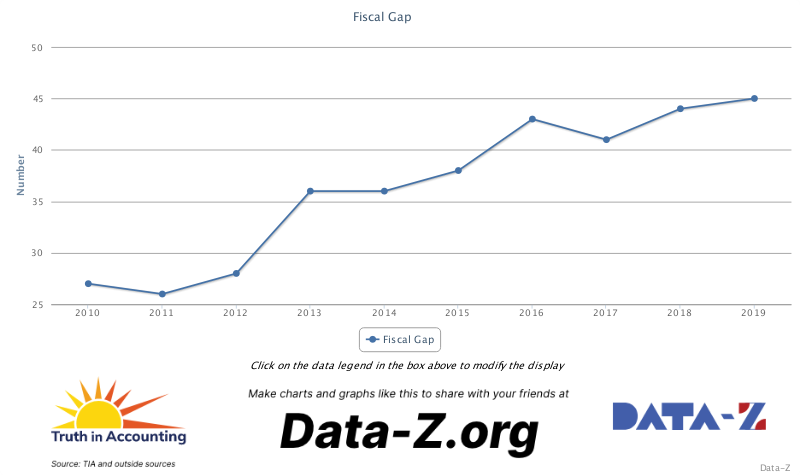

The calculated “fiscal gap” has been growing in recent years. The financial calculations for the fiscal gap are complex, and rest on debatable assumptions. But we can do some simple rhetoric analysis to provide some perspective.

The chart below is created with Truth in Accounting’s “Data-Z”database. It is based on the “Rhetorical Analysis” section we have developed for the federal section of Data-Z, which currently tracks the number of times given words or phrases appear in the Financial Report of the U.S. Government.

As we’ve previously reported, the use of the terms “unsustainable” and “disclaimer” have been on a sharp long-term uptrend in that report. But how about the “fiscal gap”?

The term “fiscal gap” appeared 27 times in 2010, rising to 45 times in 2019 – a 66 percent increase over a period when the number of pages in the report was basically flat.