Billions of Dollars of Liabilities are Maintained Off-Balance Sheet

Using states’ assumptions to calculate their unfunded retirement liabilities, TIA researchers found states have accumulated pension and OPEB liabilities totalling nearly $1.2 trillion. This study determined only $229 billion of these liabilities are reported on state balance sheets. More than $956 billion of these retirement liabilities are maintained off-balance sheet. This lack of transparency is due to reporting requirements established by the GASB.

- Until 1997, states were not required to disclose their unfunded pension liabilities

- That year GASB instituted an accounting standard (GASB Statement No. 27) that required states to disclose some unfunded pension liabilities

- States were then required to show unfunded liabilities on their balance sheets – but slowly, over 40 years

- The standard allowed states to amortize pension benefit enhancements made after 1997, also slowly added to the balance sheet over a 30-year period

Statement No. 27 also required states to include the cost of retirement benefits employees earn each year on their income statements, as a “pension expense.” The pension expense also included the amortization of benefit enhancements and prior costs, including the pre-1997 liabilities. The combination of these two elements, plus interest, is known as the ARC. With certain adjustments, the ARC is the employer’s entire required contribution for the year. If a state contributes the ARC amount yearly, it will eventually fully fund promised pension benefits. If it contributes less than the ARC, this deficiency becomes a Net Pension Obligation. The Net Pension Obligation is reported on the state’s balance sheet and accumulates each year the ARC is not fully provided. But only sophisticated readers of the state CAFR may know that this liability as reported on the balance sheet is not the state’s total unfunded pension liability. TIA researchers found that pension related liabilities of $548 billion do not appear on state balance sheets, or 87% of the total.

In addition to pension benefits, most states provide employees with OPEB, primarily retiree health care benefits. Not until 2008 did GASB institute reporting requirements for this liability. Until then most states did not even calculate their OPEB liabilities, representing future health care benefits their employees had already earned as a part of compensation. Like pension liabilities, rather than showing OPEB liabilities on state balance sheets immediately, states may amortize the pre-1998 unfunded OPEB liabilities over up to 30 years. To the extent the state does not contribute the calculated OPEB expense to the related plan; a Net OPEB Obligation is reported on the state’s balanced sheet. This study also found that OPEB related liabilities of over $410 billion do not appear on state balance sheets, or 73% of the total.

For the most part, states have not set aside money to pay OPEB benefits, relying on a “pay-as- you-go” system. TIA’s analysis of all 50 states found only five cents has been set aside to fund each dollar of the promised retirees’ healthcare benefits.

See Appendix V – Schedule of Reported vs. Unreported Retirement Liabilities for detail by state.

Determining state retirement liabilities is difficult due to the opacity of financial and actuarial reports for retirement plans of states and their component units. Calculation of some states’ retirement liabilities is made even more difficult when the state is involved in a multi-employer, cost-sharing retirement system.

- Under such a system, several employers, which may include municipalities, universities, colleges, school districts, and state agencies, have created one system combining their retirement assets and liabilities

- Very limited information about the multi-employer, cost-sharing retirement system is required to be included in the state’s CAFR

- In the vast majority of instances, the state’s portion of the Unfunded Actuarially Accrued Retirement Liability is not included in the state’s CAFR

To compensate for limited information about multi-employer, cost-sharing systems, TIA researchers attempted to contact state financial report preparers and/or plan administrators, and government officials told TIA researchers that they did not know their state's share of the pension liability. In one instance, one plan administrator stated, “We do not break out UAAL or contributions by employer type. Therefore the information you are requesting is not available. You will need to use the state’s share of plan active members to calculate the state’s share of the UAAL.”

Despite these challenges in determining each state’s share of their multi-employer, cost-sharing plans, TIA researchers analyzed each individual pension and OPEB plan and included applicable unfunded liabilities in calculating each state’s financial condition.

For the most part, TIA calculated the state share of these multi-employer, cost-sharing plans using a percentage of historical contributions.

Soon the full retirees' health care liability will also be reported

On September 11, 2014 during her testimony before GASB, Sheila Weinberg, TIA Founder and CEO, said, "TIA wholeheartedly agrees that reflecting OPEB obligations as liabilities in financial statements is critical to fair presentation of the financial impact of these commitments on citizens and taxpayers." On June 2, 2015 GASB officially approved two new accounting statements for improving accounting and financial reporting for OPEB: GASB Statement No. 74, Financial Reporting for Post-employment Benefit Plans Other Than Pension Plans, and GASB Statement No. 75, Accounting and Financial Reporting for Post-employment Benefits Other Than Pensions. GASB Statement No. 74 will be effective for fiscal years beginning after June 15, 2016 and GASB Statement No. 75 will be effective for fiscal years beginning after June 15, 2017. The new OPEB standards parallel the pension standards in GASB Statement No. 67 and GASB Statement No. 68. Under these standards, unfunded OPEB liabilities of state and local governments will be reported on the face of their balance sheets, instead of being hidden in the notes of government financial statements. These new statements should provide much needed transparency. Unfortunately, these changes won’t be visible on balance sheets of most states until 2018.

What we thought would happen

TIA anticipated that GASB Statement No. 67 would result in significant increases in many of the states' unfunded pension liabilities. In 2013, 37 states had funding ratios below 80%, which is what federal law would classify as "endangered." As a result, we expected that actuaries would predict many plans would run out of assets before all promised benefits are paid. Then, according to the new standard, the actuaries would be required to use the 20-year municipal bond index rate to discount the remaining unfunded benefits. This portion of the benefits would be valued at a significantly higher amount than it would have been using the historical rate of return. This would result in a significant increase in the unfunded liability.

What actually happened

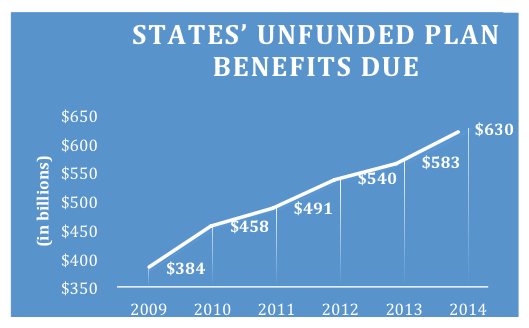

What TIA researchers found was the unfunded pension liabilities for the 50 states in total didn’t increase significantly. In fact, the amount of total pension shortfall increased at approximately the same rate as the last five years. According to state pension plans' financial reports, 34 states' unfunded pension liabilities decreased from 2013 to 2014.

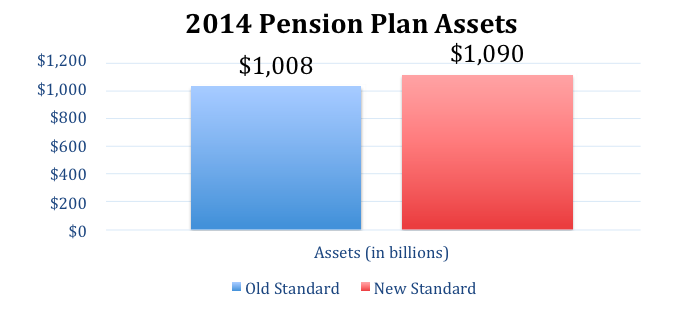

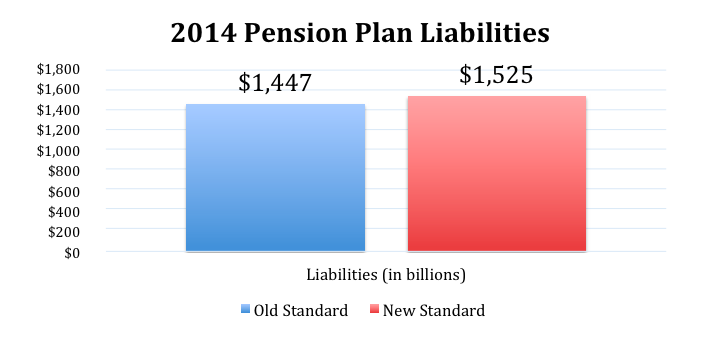

There could be many reasons besides the impact of the new pension standards that might reduce states' unfunded pension liabilities, so the best way to see the impact of the new standard is to look at plans with the same actuarial valuation date that calculated the UAAL using the old standards and the NPL using the new standards. We found 68 plans from various states that met these criteria, and the results of our examination are presented in the following charts.

The asset value is slightly higher when calculated using the new standard. This is because under the old standard, asset values were usually calculated using smoothing, which averaged the market value over a five-year period that included the recent recession. Under the new standard, asset values are calculated using market value, which is higher than the five-year average.

As evidenced above, the liabilities are not significantly higher under the new standard. Most plans’ actuaries are assuming plans will not run out of assets, so lower, blended discount rates were not used in the valuation of the pension liabilities.