One side on the fight over the Illinois budget recently worked to pass legislation imposing significant new tax increases. Enactment of the bill is far from certain, given the opposition of the governor.

In recent months, coincidentally, various parties have produced research making a case that Illinois has room to raise taxes, especially when compared to its neighbors.

At Truth in Accounting, we try not to “take sides.” But looking things over with tools at our State Data Lab website, it seems hard to call Illinois undertaxed, at least compared to its Midwest neighbors.

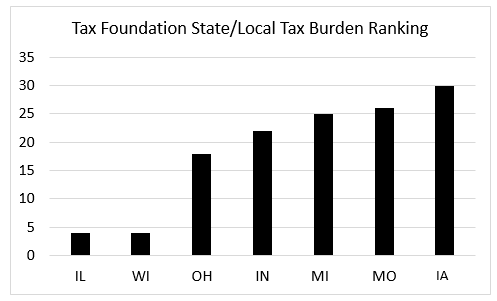

The chart below shows the rankings for Illinois and six Midwest neighbors (Indiana, Iowa, Michigan, Missouri, Ohio, and Wisconsin) on a “Tax Burden” measure compiled by the Tax Foundation. This measure is valuable in part because it adds taxes at both state and local levels, as a share of state personal income (many states differ in the share of taxes at state and local levels). Illinois and Wisconsin are tied for the 4th “highest” ranking (the highest burden) in the 50 states in the nation – and significantly higher than their neighbors.

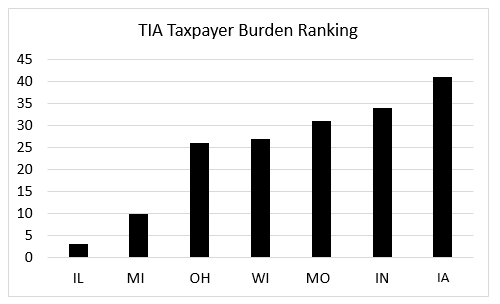

In turn, the next chart shows the ranking of these seven states on Truth in Accounting’s “Taxpayer Burden.” Our Taxpayer Burden metric differs from the Tax Foundation’s for a few reasons, mainly because our measure is more of a balance-sheet perspective on financial condition and the debt load facing taxpayers, while the Tax Foundation’s measure is more of a current “income statement” measure of current tax payments relating to current income.

Illinois ranks among the five “worst” (highest) states on our Taxpayer Burden, significantly higher than most of its neighbors.

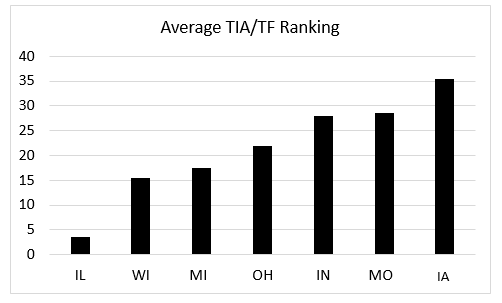

Given the differences between the Tax Foundation and Truth in Accounting’s methodologies, it can also be useful to look at how the states rank compared to each other on the average of the two rankings shown above. (Here’s an article I wrote for Governing Magazine exploring the relationship between these two measures.)

Illinois clearly ranks worst among its neighbors on this measure, as well.

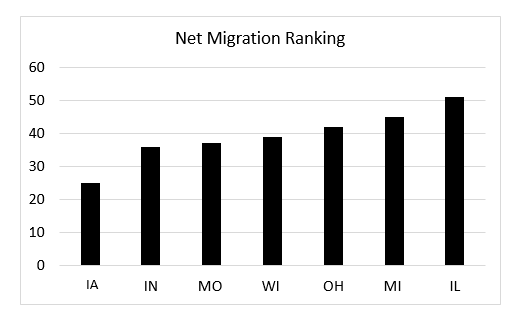

If Illinois is growing faster than its neighbors, perhaps that growth can help support the state amidst these burdens. When ranking these seven states on net migration since 2010, however, Illinois also shows up as the worst here – in fact, Illinois ranked last among the 50 states (and Washington DC).

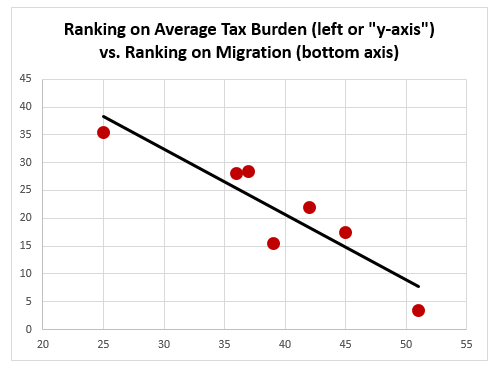

In turn, the chart below relates those seven states’ rankings on migration to their rankings on the average “Tax Burden.” There is a pretty tight relationship – states with higher tax burdens are also enduring significant outmigration – even within the Midwest.

Where is Illinois, on the chart above? It’s down-there-at-the-lowest-and-to-the right.

Meanwhile, it’s not like Illinoisans are fleeing just for Florida and the Sunbelt. The Census Bureau produces annual estimates for state-to-state migration flows. The table below shows the latest year’s (2015) estimates for migration to Illinois from those other six states, as well as the migration from Illinois to other six states. For all six comparisons, migration has been net positive out of Illinois, particularly for its closest neighbors.

What do you think? Does Illinois have plenty of room to raise taxes?