You can view a PDF Version of the report here.

Report findings

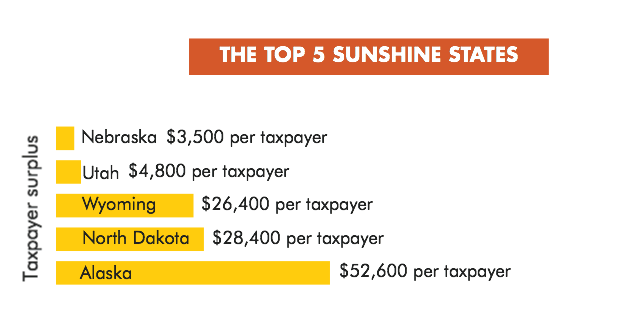

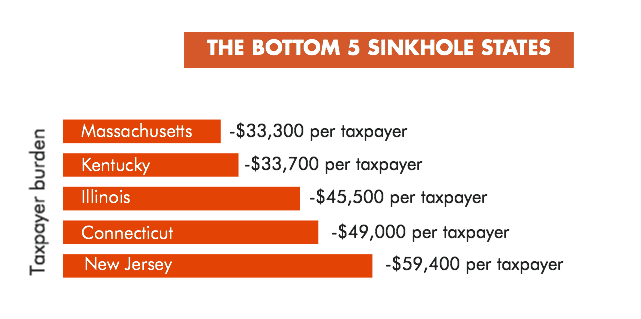

Top 5 sunshine and bottom 5 sinkhole states

How your state balances its budget, while going into debt

Retiree health care debt rule will be in effect in two years

Truthful, transparent, and timely information is important

How is my state doing? 50 state ranking

Government reports are complicated, long documents. At Truth in Accounting (TIA), we believe that citizens deserve easy-to-understand, truthful, and transparent financial information from their governments. Without this, how can they participate in democracy?

In order to give citizens the government financial information they deserve, Sheila Weinberg founded TIA in 2002. At TIA’s inception, Sheila’s work focused on the federal government, specifically how the government could claim it had a surplus even as its debt was rising.

As Sheila became more involved with government financial analysis, her research spread to the state level. In 2009, Sheila expanded her efforts, and completed an analysis of the finances all 50 state governments. As TIA has grown, our research now also extends to the city and municipal levels.

In 2011, we created State Data Lab (SDL) to give context to our data. Our users can use SDL to see how their state or city government is doing, compare it with other states and cities, and see demographics, economic, and financial trends.

In order to achieve our mission of educating and empowering citizens with understandable, reliable, and transparent government financial information, we produce reports at the federal, state, and local level for citizens. These reports cut through political tricks used in government finance, and are presented in plain English, so citizens can understand their government’s true financial condition.

Every September, we launch our report entitled The Financial State of the States. This is a comprehensive analysis of the 50 state governments’ finances, and includes background on new finance standards coming into play, trends across the states, and key findings.

Here’s a number for you, $1,328,204,440,079.

That’s how much states across the US need to pay all their bills. While there are states, like Illinois and California, that are notorious for their financial woes, did you know that 40 out of the 50 states do not have enough money to pay all their bills?

Our nation is facing a financial crisis. Across the board, state governments have racked up a total of $2.4 trillion in debt, according to our latest findings.

How has this happened? Through accounting gimmicks, government officials have been able to hide the true cost of government, playing tricks with the balance sheet and not accurately reporting pension and retiree health care debt.

States sink further into debt while keeping the budgets “balanced” through tricks such as borrowing money to balance the budget, delaying the payment of current bills until the next fiscal year, and inflating revenue assumptions.

While these issues may seem boring or complicated, they have real, tangible consequences. When broken down per taxpayer, and looking across the 50 states, the average taxpayer’s share of state debt is $13,514. Do you have an extra 13 grand to send to your state government? In the worst state, New Jersey, each taxpayer’s share of state debt is $59,400. That’s just $150 shy of a full year’s tuition at Harvard.

Why does this matter?

Without an informed electorate, democracy doesn’t work very well. Because of existing structures for both accounting and reporting, citizens do not receive truthful, transparent, or timely government financial information. Without access to understandable, reliable, and honest information, how can citizens be knowledgeable participants in their government?

Why now?

It matters now because the crisis is already beginning in many states. Illinois is one of the most notorious examples. Because of the state’s fiscal problems, its credit rating was downgraded to just two steps above junk, its public school system is in crisis, and during the budget impasse, hundreds of nonprofits were forced to lay off employees due to a lack of funding.

Will we ever have to pay this money back?

Although Taxpayer Burden™ (each taxpayer’s share of state debt) may seem like an intangible thing, it is a real cost that taxpayers will eventually have to pay, whether it’s in the form of higher interest rates, tax increases, or less government programs. Perhaps your state won’t fall into complete crisis in your lifetime, but your children or grandchildren will be on the hook.

Puerto Rico has already begun to see the effects of racking up debts it can’t afford. This past year, Puerto Rico defaulted on $70 billion of its debt, sending bond investors and politicians alike scrambling. If states continue on their current trajectory, some may face the same reality that Puerto Rico and its backers (both explicit bond buyers and implicit taxpayers).

Can the federal government afford to rescue states like it did in Puerto Rico’s case? What will happen if it cannot?

Each year, we rank the 50 states from best to worst based on each taxpayer's share of state debt. We call the best states the sunshine states. This year's top sunshine states are:

This year, Nebraska joined the ranks of the top 5 sunshine states, as its financial condition improved and South Dakota’s simultaneously worsened. Nebraska’s Taxpayer Surplus™ increased by $700, and South Dakota’s surplus decreased by $700.

The worst ranked states, or states with the individual Taxpayer Burden™, are called the sinkhole states. This year, the bottom sinkhole states are:

The states in our sinkhole group are the same as last year, but as you can see, these states’ financial conditions got significantly worse in comparison to how the sunshine states improved.

If a state has a balanced budget requirement, you would think that means state spending is equal to money brought in during a specific year. Unfortunately, in the world of government accounting, not everything is how it appears.

All 50 states except Vermont have balanced budget requirements. Yet, even with these rules in place, states have accumulated almost $1.3 trillion of unfunded debt.

How can states rack up debt and balance their budgets at the same time? It all depends on how you count.

States balance budgets using accounting tricks, such as:

- Inflating revenue assumptions

- Counting borrowed money as income

- Understating the true costs of government

- Delaying the payment of current bills until the start of the next fiscal year, so they aren’t included in the calculation

One of the biggest accounting trick states use is to hide a large portion of employee compensation off the balance sheet and budget. Employee compensation packages include benefits like health care, life insurance, and pensions. States become obligated to pay these benefits as employees earn them.

Although these retirement costs will not be paid until the employees retire, these still represent current compensation costs. If states didn’t offer pensions and other benefits, they would have to compensate their employees with higher salaries.

States should be accountable, include these earned benefits in the budget, and fund them in the years employees earn them. Unfortunately, some elected officials have instead chosen to use money that is owed to pension funds to keep taxes low, while paying for more politically popular programs. Instead of funding promised benefits now, they have been charged to future taxpayers. By shifting the payment of employee benefits onto future taxpayers, it allows the budget to look balanced.

Timely information is crucial during government decision processes, like budgeting. However, most states issue their Comprehensive Annual Financial Report (CAFR) long after their fiscal year end. The standard deadline for states to publish their CAFRs is 180 days after the end of their fiscal years. The national average for publishing these reports is 192 days, 12 days after the deadline.

To give some perspective, most corporate financial reports are issued within 45 days of their respective fiscal year ends. Many question why states cannot meet this goal. There are internal difficulties and obstacles for states to reach this standard; however, timely financial information is critical so citizens and legislators can be knowledgeable participants in crucial decision making processes, like voting and budgeting.

In 2015, 28 states published their financial reports after the 180-day deadline. In 10 states, the financial report was not published until over 250 days after the fiscal year end. This number of states publishing late is up from 7 in 2014, and just 4 in 2013. New Mexico was the tardiest state, publishing a full 377 days after its fiscal year end. As of September 8, 2016, Alabama had not issued its financial report for fiscal year ended September 30, 2015.

In our unique world of government accounting, New Mexico is an odd place. It performs poorly every year without fail for financial timeliness. For the past 3 years, New Mexico has won our Tortoise Award for being the worst state for publishing its financial report on time. Last year, the report was 407 days late.

This year, New Mexico garnered our attention for a different reason- its Taxpayer Burden™ went from -$9,700 in 2014 to +$2,400 in 2015. Hurray for New Mexico? Not quite.

TIA researchers have not been able to ascertain exactly why this difference occurred. The following was noted in the state’s financial report:

“The majority of the increase is primarily due to the reclassification of the Land Grant Private Purpose Trust Fund to the Governmental Land Grant. Due to this reclassification, the restricted fund balance of the governmental increased by over $12.1 billion.”

This statement leads to questions like, where was this money previously? Why wasn’t it reported by the state before? Is the use of the money restricted?

Similar to previously hidden pension debt, in two years a new rule will be enacted forcing states to report all retiree health care debt. Like the new pension standard, this will require states to put their retiree health care debt on their balance sheets. Our study found 72% was not included in 2015.

Below you can see a pie chart comparing reported retiree health care debt (in red) to hidden retiree health care debt (in orange) for 2015.

Without an informed electorate, democracy does not work well. Because of current structures for both accounting and reporting, citizens do not receive truthful, transparent, or timely government financial information. Without access to truthful, timely, and transparent information, how can citizens be knowledgeable participants in their government?

Lack of transparency in government finance leads to the following problems

- Accounting tricks allow elected officials to claim balanced budgets, giving citizens a false sense of security, while states sink further into debt.

- Citizens do not know the true cost of their state government, and elected officials are able to spend amounts larger than the state’s revenues.

- Complex pension schemes (that both citizens and elected officials have difficulty understanding) have racked up massive debts, putting the states even further in the red.

- Voters have re-elected leaders based on false claims that budgets were balanced.

- Legislators have created and continued new programs and increased services without knowing the true cost of government spending.

- Our representative form of government is being undermined because citizens have become cynical and do not trust their governments.

States should use financial reports from the previous year to help guide a more accurate and realistic budget for the following year. However, because financial reports are not timely, they cannot be used to assist the budgeting process. Furthermore, these budgets do not include all costs—they exclude large portions of compensation costs, because retirement benefits are earned, but not fully funded. Until this year, most pension debt was also hidden. (Thanks to GASB 68, most of the pension debt is now being reported on the face of the balance sheet.) However, some states continue to play games with pension debt, using last year’s numbers even though current data is available.

Accurate accounting requires all expenses to be reported in the state’s budget and financial statements when incurred, not when they are paid. Truthful budgetary accounting must incorporate all current compensation costs, including the portion of retirement benefits employees earn every year.

States’ efforts to begin climbing out from their current financial holes must begin with honest government accounting. Only then can responsible alternatives to place the state on stable financial footing be developed and debated. The saying goes, “if you can’t measure it, you can’t manage it.” How can states begin to find solutions to this crushing debt if they don’t know how much debt there is?

FACT-based budgeting requires governments to include expenses in their budgets when they are incurred, regardless of when they are paid. If a government promises pension benefits in the current period and must pay retirement claims in future periods, the liability and expense is recorded in the budget when the benefit is promised and earned. When the cash is actually paid, the liability is removed.

FACT-based budgeting allows states to have complete knowledge of the financial health of the government. FACT-based budgeting also ensures that future taxpayers are not left with the bill for services that they never received.

FACT-based budgeting’s benefits include:

- Knowing long-term effects of current decisions

- Politicians would stop hiding costs and finances would be transparent

- Accurate, timely information would be available to all

Because state financial statements do not report all of each state's liabilities, elected officials and citizens are making financial decisions without knowing the true financial condition of their state. The lack of truth and transparency in state government accounting prevents even the most sophisticated user of state financial documents from understanding and judging a public sector entity’s financial condition.

As a result, Truth in Accounting believes it is imperative to provide an honest accounting of each state's financial condition. Therefore, we developed a sophisticated model to analyze all assets and liabilities of all 50 states, including unreported liabilities. Annually since 2009, TIA has released its "Financial State of the States" study, exposing the truth about each state’s financial position.

As the Association of Government Accountants has stated,

“ . . . it is difficult to overstate how efficient reporting of government financial information contributes to a healthy democracy. Without accurate fiscal information, delivered regularly, in an easily understandable format, citizens lack the knowledge they need to interact with—and cast informed votes for—their leaders. In this regard, a lack of government accountability and transparency undermines democracy and gives rise to cynicism and mistrust." (Association of Government Accountants, 2008)

Since all levels of government derive their just powers from the consent of the governed, government officials are responsible to report their actions and the results in ways that are truthful and comprehensible to the electorate. Providing accurate, useful, and timely information to citizens, the news media, and other governmental officials is an essential part of government responsibility. The lack of transparency for financial information, state budgets, and financial reports makes it difficult for state governments to meet this responsibility.

This is the motivation and foundation for the non-partisan mission of Truth in Accounting: To educate and empower citizens with understandable, reliable, and transparent government financial information. Truth in Accounting is a non-profit, politically unaffiliated organization composed of business, governmental, and academic leaders interested in improving financial reporting. Truth in Accounting makes no policy recommendations beyond improvements to budgeting and accounting practices that will enhance the public’s understanding of their governments’ financial matters.

Recommendations to citizens:

- To better understand your state’s finances, go to StateDataLab.org and read about your state.

2. Encourage your politicians to truthfully balance the budget.

3. Promote accountability of your elected officials by demanding the use of FACT-based budgeting.

Recommendations to elected officials:

Healthy accounting practices include accurately reporting all debts, while also accounting for expenses as they are incurred – not only when they are paid. Therefore politicians should:

- Use FACT-based budgeting

- Determine the true debt of the state, including all post-employment benefit programs.

- Stop claiming to balance the budget while putting off expenses into the future, placing a larger debt onto incoming generations.

- Go the extra effort to retrieve the most accurate asset and liability values.

- Provide state financial information to taxpayers in a more timely fashion and do not misrepresent the publish dates.

Recommendations to state financial report preparers:

- Implement new retirees’ health care standard early by putting full-unfunded retirees’ health care liabilities on next year’s balance sheet.

- Release the financial report on time

- Use the most recent pension data, not the previous year’s.

Recommendations to standard setters:

- Require governments to use the most recent pension data.

- Require governments to implement the new retirees’ health care standard in the preparation of the next year’s balance sheet.

TIA researchers use a thorough approach to determine the state of government finances. This approach compares bills—including those related to retirement systems (excluding debt related to capital assets)—to state assets available to pay these liabilities.

Data for this report was derived from states’ 2015 financial reports and related retirement plans’ actuarial reports.

TIA ranks each state by Taxpayer Burden™, or the amount each taxpayer would have to pay the state’s treasury in order for the state to be debt free.

See how we calculate a state’s Taxpayer Burden™ below:

Some states may have a Taxpayer Surplus™, which is each taxpayer’s share of the state’s surplus.

How is my state doing? Visit State Data Lab to see your individual state's report.

Read the full article on: Truth in Accounting