The City of Chicago’s spending has run significantly ahead of tax and other revenue in the last decade. The growth rate in its reported debt accelerated sharply after the end of Richard Daley’s last year as mayor (2009).

Chicago’s reported interest expense “blossomed” from about $400 million in 2009 to over $850 million in 2015. But Chicago’s reported interest expense dropped sharply in 2016, falling below $500 million.

Did this really happen? Has Chicago engineered a remarkable turnaround in its finances?

Doesn’t look like it. The interest component of the city’s projected debt service requirement for general obligation, tax increment, revenue bond, and business-type activity debt rose again in 2016.

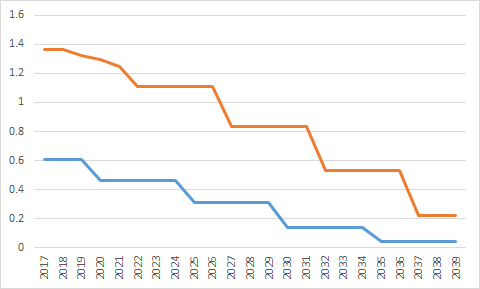

For some perspective, the chart below shows the interest debt service requirement projected in the city’s annual financial reports in 2009 (the blue line) and in 2016 (the orange line), for the years 2017 to 2039, for general obligation and business-type activity debt (the two largest categories).

From 2009 to 2016, the 2017-2039 total projected requirement tripled, rising from $6.6 billion to $19.6 billion -- in a period with declining interest rates.