Today’s Chicago Sun-Times has a lead editorial making a case for reining in Illinois state government property seizures under asset forfeiture laws. Under state law, assets can be seized if they are related to criminal activity – but “related” can be defined strictly or broadly, and Illinois has some of the most aggressive laws in the country. Civil liberties and other groups have expressed growing concern about government abuses in this area in recent years.

The Institute for Justice calls itself the “National Law Firm for Liberty.” It is a libertarian non-profit focused on litigation aimed to “limit the size and scope of government power…” The Chicago Sun-Times editorial included references to the grades The Institute for Justice assigns to the 50 states on their civil asset forfeiture laws, noting that Illinois’ grade is among the lowest in the nation.

Coincidentally, or not, Illinois government is in bad shape, financially.

Are states with financial difficulty more likely to have bad civil asset forfeiture grades from The Institute for Justice?

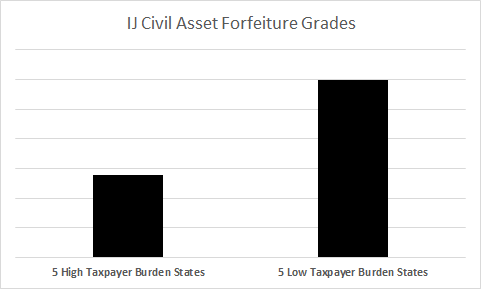

We include The Institute for Justice civil asset forfeiture grades in our “State Data Lab” facility, and can test this hypothesis. Looking at the distribution of states on our “Taxpayer Burden” measure of state finances, it does appear that states with poor finances tend to be more likely to be aggressive in civil asset forfeiture.

Here’s a chart looking at the average grades for the five states with the highest and lowest Taxpayer Burdens, for example. The five states with the highest Taxpayer Burden (including Illinois) have an average grade of D+, and the five states with the lowest Taxpayer Burdens have an average grade of C+.

Does that mean that difficult financial conditions are driving civil asset forfeiture? Maybe not. States in bad shape financially may also have criminal activity associated with aggressive policing. But this relationship is still interesting.