Some of those who downplay the risks of high and rising federal government debt refer to the debt as “money we owe ourselves.” Even if this were semi-true, in the sense that U.S. citizens were the only owners of U.S. government debt, the assertion would still be basically false. You have to answer the question “who is we?” before you get anywhere.

If one party (“we,” in this case) owed money to itself, it would be indifferent to cancelling the debt. Even if, in this case, US citizens were the only owners of US government debt, there would still be -- well, to put it mildly -- a bit of a hue and cry if the US government stopped paying interest and principal on the debt it sold to US citizens.

As ridiculous as the “money we owe ourselves” argument is in a solely domestic context, things get more serious when we consider who really owns the debt issued by the US government.

The US Treasury issues a monthly Treasury Bulletin, which includes a table with a quarterly data table titled “Estimated Ownership of Federal Securities.” The table starts with “Total public debt,” from which it subtracts “SOMA and intergovernmental holdings” (Federal Reserve and social insurance trust fund holdings) to get to “Privately held debt.”

In the latest reporting period, total “Privately held debt” amounted to $10.7 trillion (Trillion). Within that category, the Treasury reports amounts for the following categories of owners:

Among these 8 classes of “Privately held” investors, the “Foreign and international” category is far and away the most significant. In the latest reporting period, “Foreign and international” holdings totaled $6.2 trillion – almost 60% of total “Privately held debt.”

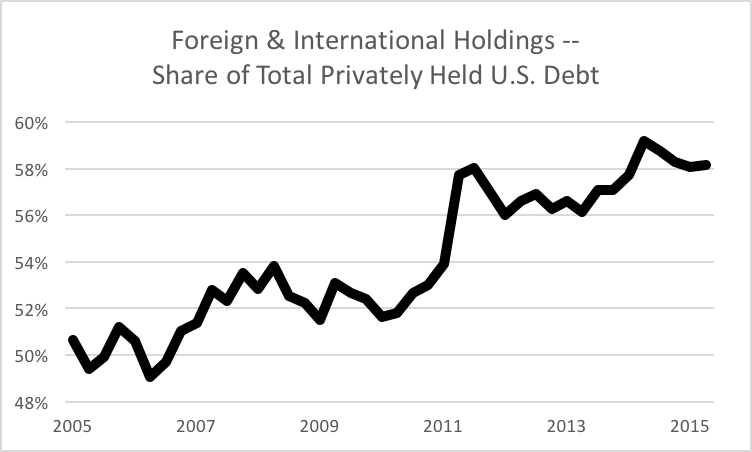

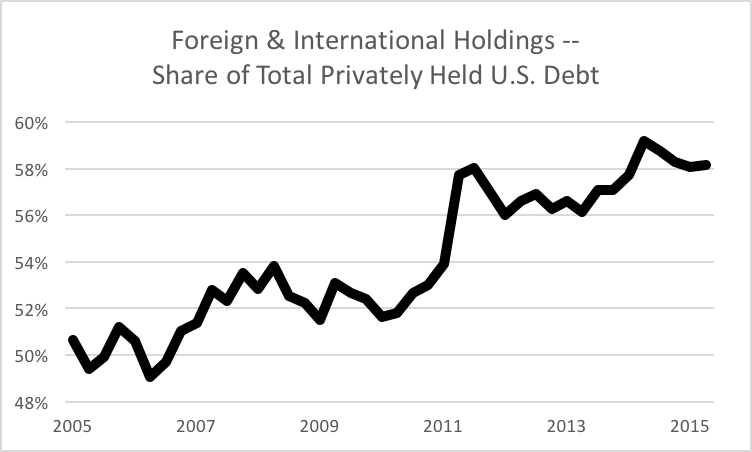

Here’s a chart showing the share of foreign and international holdings in “Privately held debt” since 2005:

Those “Foreign and international” holdings aren’t exactly “Privately held debt.” About $4.1 of the $6.2 trillion are in “foreign official” (e.g. government) accounts. A separate report (jointly produced by the Treasury and the Federal Reserve) lists the countries of ownership for U.S. federal government debt. The table lists 35 individual counties, with two of them – China and Japan – by far the largest holders.

In the latest reporting period, China and Japan holdings came to $2.4 trillion. The next largest foreign category (“Caribbean Banking Centers”) was reported to own about $300 billion.

Money we owe ourselves?

In a Facebook post a few days ago, economist Robert Higgs included the following observation:

“The system is virtually immune to significant change. It will grind on till the day it can no longer grind on, which will be the day that foreigners refuse to lend it the vast sums it needs to continue ‘business’ as usual.”