Last week, one of the major, well-entrenched credit rating “agencies” lowered its rating on the debt of the Chicago Public Schools (CPS) even further. Covering the story, a major Chicago newspaper story talked about how the “agency” also maintained a negative outlook going forward, and lamented that this will likely mean higher interest costs for CPS going forward.

This story is certainly discouraging, and not only for Chicagoans. It suggests our media slavishly continues to bow to credit rating companies as authorities. This despite their miserable failures leading to the financial crisis of 2007-2009, and significant financial research suggesting that credit ratings follow, rather than lead, changes in credit quality reflected in market prices (and interest rates).

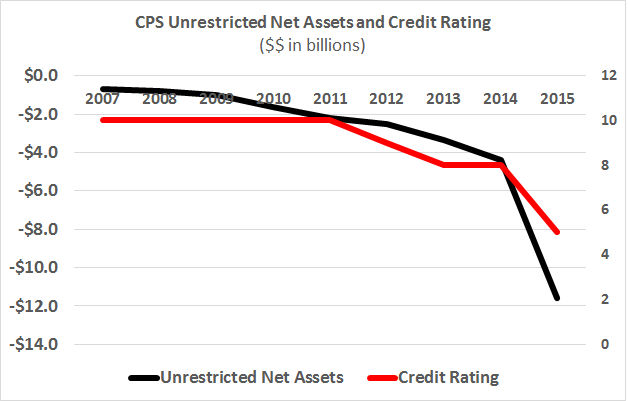

The chart below shows the unrestricted net assets reported by the Chicago Public Schools from 2007 to 2014, together with a quantified version of the rating provided for CPS by another major credit rating firm. Over this period, CPS spent significantly more money than it took in. Borrowing rose to make up the difference, and the unrestricted net position (similar to equity, in the private sector) fell.

The chart suggests that, if anything, the credit rating was a lagging indicator. One could have relied on accounting results alone to gauge the deterioration in CPS’ financial condition.

One problem with that is that accounting results are not delivered at the same time as the results occur, but with a lag. Last year, for example, we didn’t get CPS’ financial results for almost six months after its June 30, 2015 fiscal-year end (much slower than results are delivered in the private sector).

But even with that lag, it seems hard to see much value in those credit ratings.

Not that the CPS didn’t think so. In its annual report for 2007, at the beginning of the period of massive deterioration in the chart above, the CPS annual financial report included:

“The following table presents the increased debt ratings for the CPS since 2000. The increase in debt rating has provided CPS with a wider market for its bonds as well as lower pricing and insurance costs. These ratings reflect the secure structure of the bonds as well as increased confidence in the CPS management team and financial stability. …”

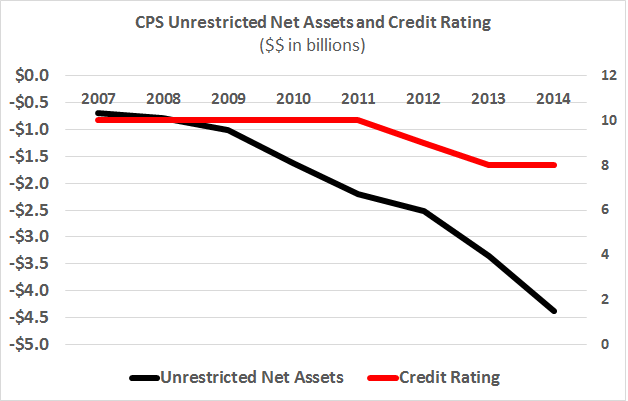

Speaking of massive deterioration, the chart below updates the chart above to include 2015, for both unrestricted net assets and the credit rating. That massive downturn in 2015 reflects how CPS, like many other state and local government units, finally reflected a net pension liability on its balance sheet in 2015, after many years of puffed-up balance sheets allowed by government accounting standards.