My son was in a rugby tournament this past weekend, in a “sevens” (7 on 7) format. At one point during a game, the other team had eight guys on the field, and a semi-dispute arose whether that was a choice or a delayed substitution. The other coach yelled across to our coaches “I know how to count!”

One of our coaches (British blokes) replied, “Yeah, Chicago counting!”

Speaking of Chicago, the city’s recently-released annual financial report included a massive increase in new “deferred outflows.” The increase was due primarily to changes in assumptions in worker pension plans. These changes imply the plans have been much more costly than previously reported by the city.

Curiously, governmental accounting standards allow state and local governments to book these “deferred outflows” together with assets, and then amortize them to expense over time. When the new deferred outflows are booked, they are added to assets, which insulates the net position from what could be even greater impairment at the time they are recognized.

Chicago hasn’t been alone on this one. But taking a look at New York City and Los Angeles suggests something strange has been operating in Chicago.

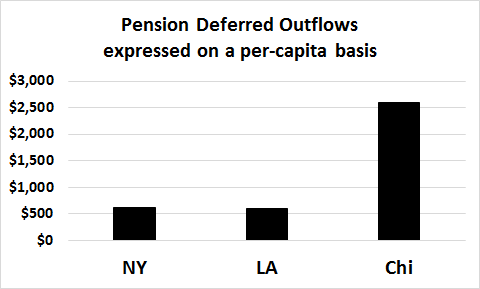

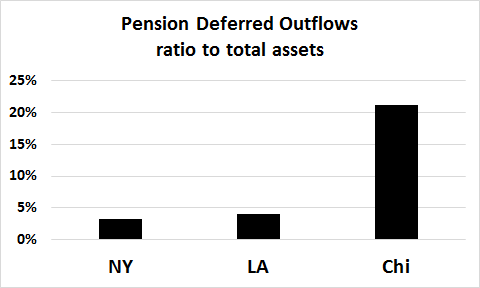

In their latest financial reports, New York City and Los Angeles included new pension deferred outflows of $5.1 billion and $2.3 billion respectively. In Chicago, the new pension deferred outflows were reported at $7 billion.

Chicago is a big city, but not as big as The Big Apple or LA.

The first chart below shows these new deferred outflows on a per-capita basis for these three cities. The second chart computes a ratio of deferred outflows to total reported assets.