Last week, The Civic Federation and the Federal Reserve Bank of Chicago hosted a conference titled “Chicago’s Fiscal Future: Growth or Insolvency?” Summarizing the event for MuniNet Guide, Jeffrey Garceau wrote an article headlined “The vote is for Chicago growth at conference on fiscal future,” which included:

“The panel, when pressed to vote for growth or insolvency in Chicago’s future, all voted ‘growth’. Chicago has a diverse, dynamic economy, a superb higher-education environment, including an improving community-college system, and commercial and residential real-estate prices that are still very competitive compared to other global cities in the U.S., like New York and San Francisco.”

On the other hand, summarizing the event for Wirepoints Illinois News, attendee Mark Glennon wrote:

“This event was a whitewash that the Chicago Fed and The Civic Federation should be ashamed of. The best presentation was from Harrison J. Goldin, a veteran of New York's turnaround in the 1970. He emphasized the importance of the first step -- honestly measuring the full depth of the problem. We haven't even done that, and conferences like this are part of the reason.”

Can Chicago assume that its economic growth potential and property values will ensure the solvency and liquidity of its government(s) in years ahead?

Granted, property values are worth watching for what they are worth, although as one participant cautioned, property values were rising significantly in 2004-2006, just before one of the worst real estate and financial crises in US history.

This participant also tried to make a case, however, that we should consider real estate values in city boundaries as an asset on the city’s “realty-based” balance sheet. In recent years, Chicago has looked like it stacks up well against Midwestern neighbors.

In other words, Chicagoans, don’t worry about your government, because the city should consider your homes and skyscrapers among its assets.

Granted, the gubmint has eminent domain powers and everything, but ...

If, on the other hand, we should take real estate prices with a grain of salt, what have recent trends in employment looked like?

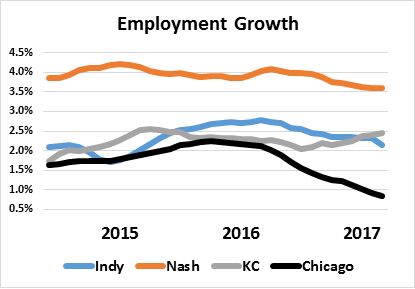

Looking at the metropolitan areas of Chicago, Indianapolis, Kansas City, and Nashville, Chicago has had easily the slowest employment growth of the four since 2014. In turn, coincidentally or not, Truth in Accounting’s solvency measure – our “Taxpayer Burden,” shows that the city of Chicago’s financial position is easily the worst of these four cities, as well.

Here’s a look at employment growth in these four metropolitan areas since 2014. Things aren’t looking so good lately for Chicago.

Granted, gubmint data isn't truth, but Chicago doesn't look good here.

Things get interesting when we compare Detroit to Chicago.

In the last year, a couple years after Detroit’s Chapter 9 bankruptcy filing, employment growth in the Detroit area has been accelerating, and is now running ahead of Chicago, where employment growth has been heading south.

Coincidentally, or not, Truth in Accounting’s “Taxpayer Burden” measure of Detroit’s financial state was even worse than Chicago’s a few years ago -- before Detroit’s bankruptcy filing.

In our latest assessments, we calculate a Taxpayer Burden for Detroit that is “only” about $14,000 – about one-third as high as it was before bankruptcy relief – and only about one-third of Chicago’s $44,000.

“Growth or Insolvency” may be a falsely-framed choice. It wouldn’t be pretty, but "insolvency" may promote growth in the long run.