We scour the web every morning, looking for new stories relating to government finances and accounting. We share some of these stories in our daily Morning Call email.

In recent weeks, financial vehicles called “pension obligation bonds” have been appearing in the news more often. Not to point a finger at one possible culprit, but an excellent July 11, 2015 article by Cezary Podkul and Allen Sloan in the Washington Post, titled “When Wall Street Offers Free Money, Look Out” appears to be one of the possible reasons.

Pension obligation bonds are longer-term bonds that tend to be issued, at least in the short run, to boost the liquidity and apparent financial strength of governments with financial pressures in their retirement plans.

In their July 11 article, Podkul and Sloan articulated the longer-term risks in this practice. These include how governments may be stretching for yield in investing bond proceeds, and driving up longer-term costs, by putting off hard decisions and kicking the can down the road. And if the risk of the funds rise with the investment of the proceeds, we may be reliving some of the worst lessons of the S&L crisis back in the 1980s, when insolvent but still-operating S&Ls gambled for recovery, and lost, trebling the cost of the crisis.

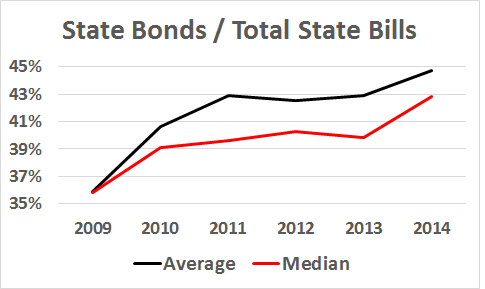

The chart below uses data from our State Data Lab website, where we have aggregated total bonds issued by state governments, and computed the share of state bonds in total state bills (including off-balance sheet liabilities related to employee retirement benefits).

All bonds are not pension obligation bonds, to be sure. But this chart indicates that bonded debt is rising in terms of total state debt, consistent with a rising role for pension obligation bonds – explicitly named, or otherwise.