Legal limits on U.S. Treasury debt could lead to defaults on federal obligations and even a government shutdown in coming weeks. We’ve been through this before, of course, and the possibility of Congress not raising the ‘debt ceiling’ seems remote.

But if Congress suspends and then raises the debt ceiling whenever it gets convenient, is it really a ceiling?

The Congressional Research Service publishes a report on the U.S. debt ceiling, including the history of its requirements, updating it regularly and when the topic rises, as in recent weeks, to a more pressing nature.

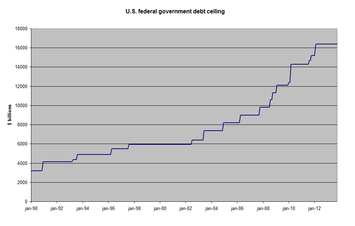

In the most recent version (“The debt limit: history and recent increases,” published October 1), D. Andrew Austin chose, well, some charitable language, i.e. “Congress has always restricted the federal debt” and “Congress has modified the debt limit 14 times since 2001.” Congress may have always restricted the federal debt, but this looks a bit like having a few folks draw buckets of water out of the Niagara River before it flows over the Falls.

And Congress may have modified the debt limit 14 times since 2001, but it could also be worth noting that each of those modifications were increases. For that matter, in the 35 years since 1979, the federal debt limit was modified 52 times, and every one of those modifications were increases.

In turn, governments can “borrow” in ways that are not strictly bound by budget accounting. This helps explain how many state and city governments have dug huge financial holes for their citizens, despite “balanced budget” requirements in state constitutions and laws. Many governments have accumulated huge unfunded obligations for retirement benefit plans, with the growth in that debt running outside the math used to give lip service to the law.

As interested parties consider the possible future facing troubled state and city governments, it can be hard to blame them if they hope for, or otherwise rely on, the possibility of federal aid as a means to staunch the bleeding.

Trouble is, our federal government has been accumulating unfunded obligations – huge ones – of its own. And in a way similar to what has happened in our state and local government. Promises to current and future Social Security and Medicare recipients now run in the tens of trillions of dollars above the present value of future inflows in these programs, and the growth in the related ‘debt’ hasn’t been included in any ‘debt ceiling.’